F E A T U R E D

ARTICLE 930

Citrus For Days

New varieties of citrus offer Pyap Produce a range of colours from pink to deep red. Image: Pyap Produce

The humble orange finds its way into most fruit bowls at some stage during the year. We know it’s a powerhouse for immune-boosting Vitamin C. But there’s so much more to citrus than many of us know. What better way to find out than with a farmer who grows 14 different varieties? And for a fruit that is usually purchased for its flesh, not its skin, why then is preventing blemishes such a big investment?

Michael Arnold from South Australia’s Pyap Produce wasn’t always a citrus guru. The family background is in dairy. “This block came up. It was rundown, but it was fairly sizeable, and it had a fair bit of water with some existing citrus plantings. Dad saw the opportunity, bit the bullet and had three young sons who were fit and ready to go,” Michael recalls. That was 20 years ago. The family currently grows 7 types of oranges, 5 varieties of mandarins and 2 lemon varieties.

Michael has swapped dairy farming for becoming a citrus guru. Image: Michael Arnold.

We do have a lot of balls up in the air.

Depth in the orchard affords the farm a longer growing season and diversification of income streams. It also offers some more boutique options to consumers. New varieties offer a range of colours from pink to deep red. “Compared to corporate growers, we’re not that big, so we need a point of difference. The climate near South Australia’s Loxton lends itself to beautiful citrus. “We need really cold nights and warm days. That fluctuation helps them stress, and that’s why it turns the ruby gene on. We seem to have a good spot here in the Riverland for those blood oranges.”

It’s an advantage. It’s a niche. We can do it better than nearly anyone in Australia.

Pyap Produce is producing about 3000 tonnes of fruit a year. As well as Vitamin C, they are rich in other antioxidants like Lycopene and flavonoids. “It’s a real selling point. People are starting to realise that food is medicine, as much as pharmaceuticals,” says Michael.

Most of those nutrients are consumed by eating citrus flesh. On occasion, consumers may use some rind in cooking, but it’s not the primary reason for purchasing citrus. Interestingly, the Arnold family has invested heavily in measures to protect their fruit from blemishes. “That’s what pays the bills. Our fruit might normally be worth $1.50 per kilo. With a blemish, maybe 30 or 40 cents.” To get around that, the business has invested in 6-metre-high nets to cover the orchard, protecting it from hail damage and occasional pests. They were among the first citrus growers in South Australia to make the investment.

We’re just blown away with how clean the fruit looks.

In addition to the aesthetics, Michael has noticed higher yields and bigger fruit, believed to be because the trees are hugging under the canopy. “It does bump the profits up a lot,” he explains. The truth, though, is a blemished piece of citrus has no bearing whatsoever on the quality or taste of the flesh.

People buy with their eyes. First appearances last.

Citrus is also hand-picked, and it’s quite an art form. Oranges have to be twisted gently enough to keep the calyx intact, while mandarins are cut with clippers. “Super time-consuming. So, again, if the fruit is small, you need to pick twice as many. It just slows things down.”

Pyap Produce are conventional growers – not organic or biodynamic. But Michael believes consumers overestimate how much pesticides and weedicides are used. “We watch what the good bugs and bad bugs are doing and only spray if we need to, if it’s out of control. If we did have to use a control, it is so specialised and targeted with the softest agent possible.”

They do residue testing on the fruit, so if you did have to use some sort of agent, it would be tested to make sure it’s not present at harvest.

So, what’s the best way to enjoy an orange? Michael says you can’t go past picking it fresh, peeling it, and eating it on the spot. But for those up for something different, he says some customers swear by eating them in the shower, so the steam unlocks the citrus oils. He’s also partial to peeling one and throwing it in the blender with a scoop of protein powder for a quick meal.

Pay In-Time Finance

Farmer Finance This Week: Stable Rates, Big Sales and Borrowing on Your Mind

This week’s biggest farm-finance takeaway is that interest rates remain steady, with no clear signal of cuts coming soon. For farmers, that means lending conditions are predictable right now — but not getting cheaper. When rates stop moving, timing becomes everything, and securing funding while lenders are steady can make a real difference.

One story that’s hit close to home in regional Victoria is the collapse of a long-running family-owned produce business. After nearly three decades of operation, the company entered administration owing millions and impacting hundreds of workers. It’s a sharp reminder that even established agribusinesses can come under pressure when cash flow tightens, costs rise, or debt structures no longer fit the business cycle.

At the same time, confidence from large investors hasn’t disappeared. A major Northern Territory cattle station changed hands this week in one of the largest pastoral property transactions seen in years. Deals like this show that long-term capital still sees strong value in Australian agriculture, even while operating conditions remain challenging on the ground.

Production outlooks are also holding firm. Recent updates point to solid cropping results, particularly in Western Australia. While strong yields are welcome, they don’t automatically solve cash-flow timing issues — inputs, freight and storage costs still need to be funded well before income lands.

Put together, this week’s news carries a clear message: rates aren’t falling, capital is still active in agriculture, and the farms that stay ahead are the ones planning their finance early.

At Pay In Time - Finance, we’re helping farmers respond to this environment by structuring loans around real seasonal cash flow, securing working capital and refinances while lending conditions are stable, and supporting asset purchases or expansion plans with finance that doesn’t over-stretch the business.

If you’re considering upgrades, growth, or simply want a stronger buffer heading into the next phase of the season, now is a smart time to review your options and get things lined up. Pay In Time - Finance

WEEKLY AUCTION DATES – 2025

INPUTS & COMMODITIES

Farmgate income climbs to a higher record level in landmark 2025-26 season

Agricultural production alone is expected to total $99.5 billion – the highest on record – and with fisheries and forestry added, will reach $106.4 billion

It’s a runaway freight train that cannot be stopped, as Farmgate income for 2025-26 just keeps on givin,g as record forecasts continue to be broken throughout the season

Record Farmgate value of $99.5 billion is being driven by a livestock market at very strong price levels and expected to continue in that vein as available stock numbers decline, along with the revival of the winter harvest, injecting steady national crop value into the mix.

And this all looks set to continue as livestock prices strengthen on the back of firm global and domestic restock demand, lifting the value of livestock and livestock product output even as turnoff of sheep, lambs and cattle moderates.

And with ideal late-season growing conditions, the national winter crop outlook is robust, with production expectations increased and on track to reach 66.3 million tonnes, the second-biggest winter harvest on record.

The somewhat later than usual harvest is well underway across all states, with significantly above-average yields reported in northern New South Wales, Queensland and Western Australia.

While, as expected, it’s a slightly dourer setting for growers in marginal parts of the upper south-east of the country, where a dry spring adversely impacted yields in well-known season-by-season tested growing regions.

It is expected that exporters will benefit from the excess of domestic market requirements, with a Farm export value projected to reach $78.9 billion. While the combined agriculture, fisheries and forestry export value is forecast to rise to $83.9 billion in 2025-26, setting another record.

All of this is leading to an expected increase in farm profitability, with average broadacre farm cash income forecast to reach $227,000 per farm in 2025-26.

This is one of the strongest positions farmers have been in for several years, and spending on infrastructure is expected to prevail when it comes to farmgate income spending leading into 2026.

Agricultural production at the farmgate is expected to total $99.5 billion, making season 2025-26 the highest value result on record, with global demand a prime factor

Money trail lights up

This is where the bulk of the Farmgate income of $99.5 billion will come from in season 2025-26.

The total value of crop production is expected to increase marginally to $53.4 billion, while the gross value of livestock and livestock product production is expected to increase by 14% to $46.1 billion.

As the 2025-26 harvest has progressed, there has not been an urgent need to increase estimates as seasonal conditions have helped deliver a well-above-average 2025 winter crop harvest, but an additional $4.8 billion has been added to reflect an increase in livestock and livestock products due to strong rises in saleyard prices.

Livestock and livestock products

In large part, livestock and livestock product gross values reflect strong upwards revisions to cattle and sheep prices as processor and domestic restocking demand have seen saleyard prices reach record highs in recent data. Record prices are expected to continue driving product values higher

When compared to last year, Livestock and livestock product gross values are forecast to rise by $5.5 billion in 2025-26 to $46.1 billion, driven by higher livestock and livestock product prices (18% higher).

Prices have been buoyed by sustained strong global red meat demand and domestic restocking activity, reflecting improved seasonal conditions. By contrast, livestock and livestock product production volumes are expected to fall by 4%, as elevated turn-off in recent years has reduced livestock available for slaughter.

The rise in livestock and livestock product values reflects an increase for cattle and calves at $3.2 billion, mainly driven by price, whereas, by contrast, beef production volumes are expected to fall slightly.

Lamb and sheep are $1.1 billion higher, as prices more than offset lower production volumes for both lamb and mutton.

Milk is also up $0.5 billion, and wool is up $0.3 billion, driven by higher prices for both commodities, with production volumes expected to fall.

While pigs, poultry and eggs lumped together are up $0.2 billion, this time driven by rising production volumes to meet domestic demand.

Crop harvest is solid

Crop production value is expected to almost mirror last year, up just $0.1 billion to reach a value of $53.4 billion in 2025-26, the second-highest result on record in nominal terms, fourth-highest in real terms.

Relatively favourable seasonal conditions in winter and spring across many cropping regions have supported strong production volumes, with a strong finish to the winter harvest, especially in Western Australia and northern New South Wales.

By contrast, global crop prices are forecast to decline in 2025-26 as record global production and stocks, especially for grains, support exportable supply.

Throughout the growing season, it became evident in the marketplace that there would be income changes in individual crop production values. We take a look at the outcome for season 2025-26 as compared to last year.

Canola production values are expected to rise by $0.9 billion, driven by increasing production volumes and higher prices as growing world demand is expected to outpace greater global supply.

Horticulture continues its strong rise with production values expected to rise by $0.6 billion, driven by higher production and prices. Price rises for export-focused horticulture commodities are expected to outweigh price falls for domestically focused products.

Coarse grains production values are expected to increase by up to $0.5 billion, as higher production – driven by an expected record barley harvest – outweighs falling global prices.

By contrast, cotton is coming in $0.8 billion lower, along with wine grape at $0.1 billion lower, with production values expected to fall, driven by both lower production volumes and prices.

Wheat value is tipped at $0.5 billion lower, along with sugarcane down $0.3 billion. Value falls reflect easing international prices, with production volumes expected to rise slightly.

Agricultural export value at record high

The value of agricultural exports is expected to reach a record high in nominal terms (second highest in real terms), rising by $3.1 billion to $78.9 billion in 2025-26.

The expected rise is being driven by higher livestock and livestock product export values, at $2.7 billion higher. While crop export values are also expected to rise slightly to $0.4 billion.

As with the forecast rise in agricultural production values, the expected 4% rise in agricultural export values in 2025-26 is being achieved by higher prices.

Livestock and livestock product export prices are expected to rise by 13%, reflecting strong global demand for beef and sheep.

But average export prices for beef and sheep meat are forecast to increase by less than domestic livestock prices in 2025-26 as restock momentum adds to domestic saleyard demand, alongside robust processor demand.

Livestock and livestock product export volumes are forecast to fall by 5% in line with expected lower livestock slaughter. This follows from red meat export volumes growing steadily over the last three years, driven by rising production and strong demand from the United States, China, Japan and emerging markets in the Middle East.

Crop export volumes are forecast to rise by 6% in 2025-26, reflecting increased production and high carryover wheat stocks.

By contrast, crop export prices are expected to be down by 5%, driven by record global production and rising global stocks across many major crop commodities.

The forecast value of agricultural exports for 2025-26 is now estimated at $4.3 billion, higher than early season predictions, largely reflecting upwards revisions to livestock product export prices and consistent with revisions to total farm production values.

Input prices to remain elevated

Not much reprieve for farmers as it is in the general economy, with input prices expected to rise by 5.0% in 2025-26, driven by rising prices for livestock, fodder, fertiliser and labour.

By comparison, fuel prices are expected to moderate, reflecting rising global production, dampening the overall increase in prices paid. Prices received for agricultural commodities are expected to rise by 6.4% in 2025-26.

Strong increases in livestock prices are expected to outweigh slight falls in prices received for grains and industrial crops.

AG MACHINERY

“By 2026, small farm equipment sales are projected to grow by 18% due to shifts in modern farming techniques.”

Farm Machinery Sales Near Me: 7 Powerful Trends for 2026

🌐 Learn more: www.realmgroup.com.au

Meta Description: Farm machinery sales near me are evolving rapidly. Explore 2025 farm machinery trends—including used and small equipment—to boost productivity with informed decisions in 2026.

As agriculture continues to modernise in 2025 and beyond, the demand for efficient and versatile farm machinery has never been higher. Whether searching for farm machinery sales near me, looking to buy used farm machinery for sale, or considering small farm machinery for sale adapted to more specialised needs, understanding current market trends and options is crucial for making an informed purchase.

From the popularity of compact and specialised equipment to the integration of cutting-edge technology and the shift towards digital sales platforms, the landscape of farm machinery sales is dynamic and evolving.

Farm Machinery Sales Near Me: The Landscape for 2026

If you’re searching for farm machinery for sale near me, you’re part of a wave of modern agricultural operators who recognise the value of local access and easy support. In 2025 and heading into 2026, proximity to reliable sellers is a primary factor—alongside cost efficiency, technological compatibility, and sustainability—in making machinery acquisition easier than ever.

Farmers seek to minimise downtime by buying from local or regional dealers with robust support networks.

Used and old farm machinery for sale is in higher demand, reflecting value-driven decision-making.

Small farm machinery for sale options have surged, catering to diversified and marginal farms.

The rapid integration of technology and online platforms is reshaping purchasing behaviour.

Sustainability, traceability, and operational flexibility are no longer optional, but central to equipment choices.

The following sections dissect 7 powerful industry trends shaping the farm machinery marketplace up to 2026, equipping farmers and operators with the insights needed to navigate sales, platforms, and services with confidence.

Trend 1: The Explosion of Small Farm Machinery for Sale and Its Impacts

The Rise of Small and Specialised Machinery

One significant trend in 2025—set to continue well into 2026—is the immense popularity and growing market share of small farm machinery for sale. These smaller operations require tailored equipment—including compact tractors, mini-harvesters, and customised implements—designed for:

Organic farming plots

Horticulture tracts

Specialty crop management in tight spaces

Listings for small and specialised machinery have surged in online marketplaces and local dealership inventories.

“Used machinery transaction volumes are expected to surpass new equipment by 25% in 2025, reflecting evolving farmer preferences.”

Benefits of Small Farm Machinery:

Affordability: Lower price points reduce financial barriers for small and medium farms.

Easier Maintenance: Simple parts, availability of local repair services, and straightforward operation.

Versatility: Machines are adaptable to a wide variety of tasks—tilling, seeding, spraying, and more.

Flexibility: Compact equipment can be stored and moved without large infrastructure investments.

Sustainability: Lower fuel use, reduced soil compaction, and better adaptation to diverse field conditions.

Strong demand for small farm machinery is shifting how dealers and local sellers approach inventory, with the 2026 market expected to see an even wider range offered.

Trend 2: Used and Old Farm Machinery for Sale – Cost, Value, and Modernisation

Why the Used Farm Machinery Market is Booming

As operational costs rise and margins tighten, farmers are increasingly seeking cost-effective ways to maintain or expand their fleet.

Old farm machinery for sale, particularly for basic operations like plowing, harrowing, and simple crop management, has also enjoyed a resurgence. This is driven by:

Simple mechanics: Older machines are easier to repair, operate, and maintain.

Availability of spare parts: Local and regional markets have adapted, providing needed parts quickly.

Proven reliability: Many used tractors and older implements remain operational for decades when properly maintained.

Faster delivery: Purchasing locally means less waiting and less risk of unexpected downtime.

What Makes Used and Old Machinery Especially Valuable?

Price: Buying used saves up to 40–60% over new machinery, freeing up capital for other investments or improvements.

Refurbished Performance: Advances in diagnostics, remotely accessible service records, and certified repair systems ensure buyers know exactly what they are getting.

Warranty & Certification: Certified pre-owned and warranty-backed used equipment options are standard in 2026, providing peace of mind.

Operators often search for used and old farm machinery via trusted local dealers, private sellers, and regional marketplaces.

Trend 3: Technology Integration & Smart Equipment

Smart Technology in New and Used Farm Machinery

Farm machinery sales in 2025 and 2026 are not just about the hardware. Technology integration has become a staple, even in used and small farm machinery for sale. Key advances include:

GPS & Telematics: Enhanced field guidance, reducing overlap and improving operational efficiency.

Automated Controls: Seeders, planters, and sprayers now feature automated drive and application systems to optimise inputs.

IoT & Connectivity: Telematics support real-time monitoring, predictive maintenance, and performance analytics—even from a simple smartphone.

Precision Equipment Compatibility: Many used and small tractors are now being retrofitted with precision agriculture add-ons.

Technology is making reliable, efficient, and sustainable crop production easier.

We recommend exploring Farmonaut’s Carbon Footprinting solution if you want to monitor environmental impacts and optimise input use, directly tying into your smart machinery’s data analytics for improved sustainability and regulatory compliance.

Trend 4: Local Proximity, Speed, and the “Farm Machinery For Sale Near Me” Revolution

Why Proximity Matters More Than Ever

For many farm operators, finding “farm machinery for sale near me” is now an essential strategy:

Quick Access: Local purchases ensure faster delivery and setup, reducing operational downtime.

On-site Support: Proximity guarantees easier access to in-person demonstrations, service, and replacement parts.

Trusted Relationships: Building partnerships with regional dealers and providers leads to better after-sales experience and custom solutions.

Adaptability: Local sellers are more responsive to the unique challenges of regional soils, crops, and climate.

Most dealers have expanded inventories and now offer online listings, bridging the gap between high-tech equipment providers and rural clients.

For operators seeking integrated farm management, the Farmonaut Large Scale Farm Management platform offers a way to monitor your assets and fields, no matter their location, complementing your proximity procurement strategies with remote oversight.

Trend 5: Innovative Sales Platforms & Digital Marketplaces

The Emergence of Online Solutions and Their Impact

The digital transformation in farm machinery sales continues into 2026. Online sales platforms—with interactive, photo-rich, and video walkthroughs—have made equipment acquisition easier, especially for time-pressed or remote farmers.

Listings for all sizes: From single-row seeders to full-size combines, everything is searchable with location-based filters.

Secure transactions: Escrow services and transparent documentation reduce risk for both buyers and sellers.

Virtual demonstrations: Machines can be inspected digitally, often with real-time video calls.

Access to peer reviews: Farmers benefit from seeing feedback, maintenance records, and operator opinions before making a purchase.

Marketplaces also encourage private sellers—farmers and operators upgrading their own fleets—to easily reach buyers in their region or nationwide.

For tracking and ensuring the authenticity of high-value assets through digital transactions, our Farmonaut Traceability solution leverages blockchain to guarantee transparency and reduce risk in every sale.

Trend 6: Farm Machinery Rental, Leasing & Shared Ownership Models

Alternative Acquisition Models Drive Flexibility

Rental and leasing of farm machinery has grown as farmers seek to adapt rapidly to changing market conditions and weather patterns—without locking up capital in long-term purchases.

Seasonal tasks: Equipment like combine harvesters and planters, used intensively during short windows.

Testing new technologies: Renting machines with advanced features before committing to ownership.

Reducing risk: Leasing or sharing equipment lowers upfront costs and ensures operational flexibility.

Innovative rental platforms now offer real-time availability, tracking, and maintenance scheduling.

Trend 7: Sustainability, Traceability & Environmental Accountability

Farmers, operators, and businesses are under pressure to balance productivity with sustainability.

Lower emissions machinery: The latest sales data shows a surge in electric and hybrid tractor offerings as part of new farm machinery for sale.

Blockchain-enabled records: Ensuring the provenance and maintenance history of used and old machines.

Carbon tracking: Operators use equipment-compatible digital tools to monitor greenhouse gas output, input use, and efficiency.

Choosing machinery with a tracked environmental footprint is becoming a competitive advantage.

Additionally, for agribusinesses seeking automated advice and resource optimisation—directly impacting sustainable production—our satellite-powered Crop, Plantation & Forest Advisory Tools can significantly enhance how you manage equipment and inputs for next-level sustainability.

Farm Machinery Sales Trends Comparison Table (2024 vs. 2026 Estimates)

Machinery Type | Sales Channel | Estimated Sales Volume (2024) | Estimated Sales Volume (2026) | Expected Growth Rate (%) |

|---|---|---|---|---|

Tractor | New | 58,000 | 62,000 | 6.9% |

Tractor | Used | 46,000 | 58,500 | 27.2% |

Combine Harvester | New | 13,500 | 15,200 | 12.6% |

Combine Harvester | Used | 9,000 | 12,200 | 35.5% |

Planter | New | 16,800 | 19,400 | 15.5% |

Planter | Used | 11,900 | 15,300 | 28.6% |

Small Equipment (Tiller, Mini Harvester, etc.) | New | 54,000 | 63,700 | 18.0% |

Small Equipment (Tiller, Mini Harvester, etc.) | Used | 32,000 | 44,000 | 37.5% |

For Sale Listings

(List It For FREE!)

Featured Auction Listings

RGA - REALM GROUP AUSTRALIA - MULTI-VENDOR MACHINERY AUCTION, AUSTRALIA WIDE

We’re now taking listings for our next up-and-coming auction.

Contact us today!

AG NEWS AUSTRALIA

Kaniva A&P Society – Wheat Crop Competition 2025

Harvest is in full swing across the district. Photo: Beverley Polhner

The Kaniva A&P Society conducted another successful crop competition in November, attracting a good variety of entries from across the district.

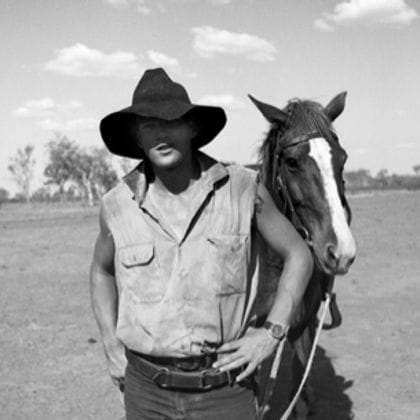

Liam Feder.Photo: Nhill Free Press & Kaniva Times

The Best Bread Wheat Crop was awarded to Feder Farming, represented by Mathew Feder. The Feders will receive $1000 worth of free brokerage from our generous sponsors, Market Check, and will be presented with the Geoffrey Hawker Memorial shield at next year’s Kaniva Show. The Tink family, Ian, Spotty and Brad, were awarded the Best Durum Crop for the second year running. Their prize is $1000 in cash from our other generous sponsor, the San Remo Macaroni Company. They will retain the Alexander H. Wallis Memorial shield at the Kaniva Show next year.

Brad and Spotty Tink.Photo: Nhill Free Press & Kaniva Times

The Kaniva A&P Society sincerely thank Hamish Mines and Jayden Hendy for their time and skills in judging the crops, and thanks Brett Jewell for helping on the day. We also sincerely appreciate the generosity of our prize donors, Market Check and San Remo Macaroni Company and thank our growers for supporting the competition with their crop entries.

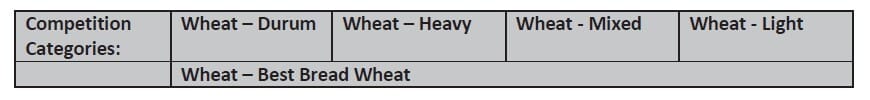

Kaniva A&P Society – Crop Competition 2025: Wheat results and report

Introduction

The Kaniva A&P Society held its annual Crop Competition for 2025, focusing on wheat entries from across the district. Key representatives involved in the event included Brett Jewell (Kaniva A&P Society), Hamish Mines (Agronomy/Agribusiness Teacher, Longerenong College), and Jaden Hendy (Nutrien Ag Kaniva).

Judging overview

Crop judging took place on Wednesday, 5 November 2025, slightly earlier than usual due to judge availability. Most crops were at mid-grain fill with prominent flag leaves, rather than the typical mid-late grain fill and haying off seen in previous years. There were 21 crop entries: 3 Durum, 7 Heavy, 8 Mixed, and 3 Light. The judging covered a wide area, from Lawloit through to the Border, ensuring full representation of the district.

Despite a late break in the season, crops showed strong yield potential. Yield estimates taken during judging averaged 3.52 tonnes, down from 4.57 tonnes in 2024. However, finishing rains in late November are expected to improve yields above the average assessed on the judging day. Notably, the health and presentation of all crops were impressive across various soil types, making judging particularly difficult. Crops on both the East and West sides of Kaniva performed equally well.

Agronomic observations

Crop husbandry remained at a high standard across all entries, with no frost damage observed. Snails were present in a few crops, more than last year, and ryegrass management continued effectively, although some resistant patches were identified. The Durum wheat entries stood out for their large grain heads and awns, with good grain fill occurring. We hope that protein specifications will be met at harvest.

The Shotgun Wheat variety also drew attention, as judged on Dyers North Servy Block. Entrants are encouraged to follow the NVT results for further insights on this new variety.

Outstanding crops

Closing comments

It was encouraging to see new entrants in this year’s competition. The outstanding crops for each category are detailed in the tables above. Special congratulations go to the Tinks for winning Best Durum on bean stubbles for the second year in a row, and to the Feder’s Sceptre, grown following vetch, which won Best Bread Wheat and will represent in the Regional Competition.

Thanks are extended to Brett Jewell for his support on the day, Daryl Wallis for his background work, and Jaden Hendy, who assisted as a judge, contributing to his Diploma of Applied Agronomy studies at Longerenong College.

After a long association with Longerenong College, I will soon be finishing and have commenced a new role with CropLife/Agsafe https://www.croplife.org.au/ and https://www. agsafe.org.au/.

I hope to still be able to help again next year.

Wishing everyone a successful harvest and a festive season.

Simply click www.payintime.com.au to provide your details, and we will be in touch. It all starts with one phone call.

YOUR TOWN

We Have Been to Your Town! We don’t just sit in an office; we are hands-on with our Farmers! 🙌

Please email us with a picture of yourself or a family member in front of your TOWN-SIGN to [email protected]

🏆 Excellence Recognised. Performance Celebrated. 🎉

We’re proud to celebrate Robbie McKenzie, awarded a Certificate of Appreciation by Global Proudly Presents for outstanding performance and dedication.

This recognition reflects the hard work, leadership, and commitment that continue to drive success across Australian agriculture and agribusiness. 👏🌾

At Realm Group, we stand behind people who deliver results—because strong industry leaders build stronger farms and futures.

🌐 Learn more: www.realmgroup.com.au

Field Notes with RD Creative Studio: Long-Term Insights from the RD x REALM Collaboration

The Reason Buyers Ghost You After Asking for a Quote

When you send a quote, and you don’t hear back, it’s easy to assume the price was wrong.

Sometimes it is. Often, it isn’t.

Because in reality, buyers usually disengage before the quote ever lands. The number just gives them time to hesitate. Or to justify a decision they’ve already made.

Ghosting is rarely about cost alone. It’s about confidence. Or the lack of it.

By the time someone asks for a quote, they are asking a different question than they think. They’re not asking “how much does this cost?” They’re asking, “Do I trust this enough to proceed?”

If the quote has to do the convincing, you’re late

What usually goes wrong

In a lot of rural businesses, the quote is the first real piece of communication that feels “official.” Up until then, it’s been a phone call, maybe a referral, maybe a quick look at the website.

To give you an idea, here’s what buyers are scanning for before they open your PDF.

Do I understand what these people actually do?

Have they done this before, for someone like me?

Does this feel organised, current, and considered?

If something goes wrong, will they be hard to deal with?

None of that is answered by a price.

It’s answered by what they saw before they asked for it. Your website. Your materials. Your emails. Your past work. Even the way the quote itself is written.

When those signals are weak or inconsistent, buyers stall.

What should exist before a quote ever leaves your inbox

Nothing fancy. Just enough signal to make the decision feel low-risk.

Here’s the baseline:

1. A website that answers basic doubts

Who you are. Who you work with. What you actually do. Not poetry. Not jargon. Just clarity.

2. Proof that looks current

Recent projects. Recent wins. Recent activity. Buyers are allergic to businesses that feel frozen in time.

3. Positioning that matches the price

If your brand looks small, scrappy, or vague, a confident number feels out of place. People don’t argue. They just exit.

4. A clear sense of what happens next

After the quote, then what? Timeline. Process. Expectations. Uncertainty kills momentum.

None of this replaces a good quote. It just stops the quote from having to carry the whole load.

The truth:

Most ghosting happens upstream.

The fix isn’t chasing harder, but in preparing better.

If you want, we can take a quick look at what a buyer sees before they ever get your quote and tell you where the gaps are.

More grounded thinking here: rdcreativestudio.com.au/blog

Read more here…

Women in Ag

Women of the outback - the unsung heroes of rural and regional Australia | Women Working in and Sustaining Agriculture Worldwide

Alice Bowler

“If you can show you’re just as good as anyone else in the industry, there’s not going to be an issue – there’s plenty of opportunity for women.”

One recent graduate is Alice Bowler, who finished the combined Bachelor of Agriculture/Bachelor of Business degree at the University of New England last year, and is working as an agronomist with AMPS Tamworth.

“I grew up on a farm just outside of Tamworth, and I always thought it was a good industry to work in,” Alice says. The first in her family to study at university, she sees herself gaining skills through professional development that she can take back to the family farm one day.

“Working with farmers – helping them make decisions, not making decisions for them – has been really rewarding,” she says. “In these times, you see the smart farmers who want to run their operations like a business rather than just a farm. They’re doing really good things to make sure they withstand the drought.”

In her work, Alice has found that her expertise is far more important than her gender. “If you can show you’re just as good as anyone else in the industry, there’s not going to be an issue – there’s plenty of opportunity for women.”

Amy Walker

“To take on management of the land, sustaining that resource for future generations, is a really valid and valuable occupation. That needs to be held in such high regard.”

Her experience echoes that of Amy Walker, an assistant farm manager at Breakfast Creek, a 3300-hectare property south of Boorowa, New South Wales.

Like Alice, Amy had enjoyed growing up on a family farm. “You always wanted to go out with your dad,” she recalls. “He’d be out building fences or chasing sheep, so you just kind of tag along – and that’s where you learn the basic skills that you need in the future in farming.”

“Once you’re in the industry, everybody is in the same boat; they live and breathe agriculture,” Amy says. “There are a lot of great people out there; they don’t care if you’re a female – if you’re willing to learn, someone will help.”

One thing both women had in common heading into the industry was supportive parents. It’s something Alicia Harrison would like to see more of. “When parents say ‘I don’t want my children to come back on the land,’ that really bugs me,” she says. “When we’re in such severe drought you can understand, but I really hate the way it’s seen as a failing if that’s all you want to do with your life, to work on the land. I think it’s an admirable ambition.”

Welcoming Simon Cheatham – RINGERS FROM THE TOP END with REALM Group Australia

Simon Cheatham- RINGERS FROM THE TOP END (RFTTE)

Simon Cheatham

Founder RFTTE - The Online Campfire | E: [email protected] or reply to this newsletter | Subscribe to this newsletter | The RFTTE Story | RFTTE MERCH

0417 277 488 | RFTTE PTY LTD | ABN 29 678 593 283

“Samantha Watkins Photography”

REALM Group Australia is proud to sponsor amateur photographer Samantha Watkins. We've seen her photography skills grow tremendously over the years, and we believe it's the perfect time for her to step into the photography world.

Click on the link to take you to her FB photography page, where you can see her beautiful photos.

It is called "Samantha Watkins Photography" https://www.facebook.com/profile.php?id=61573116870308

Samantha Watkins's sample photography.

All photos are available for purchase – simply email [email protected]

And she will be happy to assist you.

Active & Upcoming AUCTION!

(Under Auction Listings)

Let us know what you have to sell or auction - it’s FREE to List, and FREE to advertise. Please email [email protected]

Let us help you with your financial needs. Click Here www.payintime.com.au

Let us help you with your financial needs. Click Here www.payintime.com.au

— Robbie McKenzie

REALM Group Australia

REALM Group Australia (RGA) - originally est. 1992. The most trusted online Ag Marketing System in Australia. Built by Farmers for Farmers! Education is the KEY. True Pioneers - We were the first, and we are still growing. Proud Supporters of the Royal Flying Doctor Service (RFDS) & Ronald McDonald House Charities (RMHC)