F E A T U R E D

ARTICLE 912

Mechanisation drove productivity before 2000

Dr Greenville said Australian farming's high productivity rate before the year 2000 was the envy of not only global competitors, but also other parts of the Australian economy.

It was driven by increased mechanisation — such as switching to larger tractors and rotary dairies — and major changes to trade rules such as deregulation.

Simon Scowen's NSW dairy farm milks 800 cows a day.

"We saw producers shift out of wool production, and we saw the sheep flock fall from over 120 million to about 70 million that we see today, and a massive shift of those operations into cropping," Dr Greenville said.

"The cropping industry became more productive as it could grow in terms of the scale of production."

As a mixed farmer from north-east Victoria, the productivity slump prompted a mixed response from fifth-generation farmer James Russell.

"It does surprise me a little bit as a grain grower. It doesn't surprise me as much as a sheep producer," Mr Russell said.

Victorian farmer James Russell says the cost of growing crops and raising sheep means farmers rely on high returns. (ABC Landline)

"We've seen huge upticks in technology [in] our ability to grow a crop bigger and better.

"In the sheep industry, we still farm sheep in a very similar way to how we did 20 years ago.

"We don't actually get a return; it costs us money to get sheep shorn [this year]."

Cropping's annual productivity rate is sitting at 1.2 per cent, compared to 0.5 per cent for sheep, which has been plagued by low production and prices.

Dairy productivity shows a two-speed industry

Despite an annual productivity rate of almost 2 per cent in the 40 years before 2010, dairying's productivity rate has dropped to basically zero.

But ABARES said the sector is largely a two-speed industry, with some dairy farmers faring much better than others.

Simon Scowen started farming 30 years ago, milking 80 cows on a farm near Bega. (Supplied)

One of those driving up the sector's productivity is Simon Scowen, who now farms at Manningham on the New South Wales Mid North Coast. This year, Mr Scowen has built a large shed for his 800 milking cows.

With easy access to mixed feed rations, shelter, fan, and sprinklers, in the first few months since moving into the shed, he said milk production jumped by 20 per cent.

"Those that have been doing it for a couple of years in Australia, that we've gone and had a look at, they range from a 30 to 40 per cent increase in cow production by putting them in this facility," Mr Scowen said.

Dairy Australia says seven per cent of the milk produced in Australia comes from cows housed in a shed. That figure is expected to increase.

Thanks LL

Pay In-Time Finance

The ‘Green Drought’ and What It Means for Farm Finance

Across large parts of the country, paddocks are looking deceptively lush. But behind that green is a problem—pastures aren’t carrying the nutrition livestock need. This so-called green drought is leaving graziers squeezed: animals are eating, but weight gains are slow, and feed bills remain high.

At the same time, stories out of the SA Mallee show just how tough it’s become for families. Some are selling stock below cost, cutting household spending, even pulling their kids from sports, just to balance the books. The stress is both financial and emotional.

The government has promised long-term drought resilience funds, but as farmers know, those programs don’t pay for tomorrow’s feed delivery or this week’s fuel. That’s where finance has to step in.

For many, this is the moment to look at restructuring loans, building in seasonal repayment relief, or drawing on short-term working capital. With cattle and sheep markets still carrying strong export demand, the longer-term outlook remains positive—if producers can bridge the gap now.

At Pay In Time Finance, we’re seeing more farmers come to us not just chasing the cheapest deal, but looking for finance that works with their cycle: quick access for feed and freight, flexibility if the spring turns dry, and rates sharp enough to keep repayments manageable. That balance—cheap and fast, but structured smartly—is what makes the difference between scraping through and setting up for growth.

Looking Ahead

Reform talks in Canberra could ease red tape and unlock more rural investment.

Drought and disaster funds are coming, but won’t hit bank accounts quickly.

Export values remain strong, especially in beef and sheep—good news for those who can ride out the squeeze.

The grass may be green, but conditions are still tight. If you’re feeling the pressure, now is the time to lock in a finance that gives you both breathing room and the lowest possible cost. Pay In Time Finance is here to make sure that when the rain does finally break properly, your business is ready to make the most of it.

WEEKLY AUCTION DATES – 2025

1.) 22nd August 2025 2.) 12th September 2025

Ag Machinery

AgTech is used by a majority of Australian farmers AgTech is the norm among Australian Farmer and We are Leading the way on the World Stage.

A Roy Morgan survey of Australian farmers with a special focus on ‘AgTech’ (Agricultural Technology), shows 89% of Australian farmers have used, or would consider using, AgTech, compared to only 11% who would not consider using it.

AgTech use is widespread amongst farmers, with 78% of farmers using AgTech either now or in the past, and a majority of 72% of farmers currently using AgTech in their business. These results mean that only 6% of farmers have used AgTech and then given up on the technology.

The results in the Roy Morgan Farmer AgTech Survey are based on 1,001 in-depth interviews with Australian farmers conducted during April and May

Leading forms of AgTech used by Australian farmers:

Farm management software

eID tags (electronic ID tags)

Satellite technology

Precision farming

Drones

Remote sensors

A.I - Tool Kits

Farm management software, which covers everything from paddock mapping to animal genetics, feed inventory, water monitoring, and even biosecurity planning, is the leading form of AgTech for Australian farmers.

The second most widely used are eID tags (electronic ID tags). These electronic ID tags enable individual animal identification via a microchip, usually in the animal’s ear, that can be read using scanning devices.

In third place is Satellite technology, which provides farmers with detailed information on, for example, real-time data on crop performance and soil variability.

Precision farming, the fourth most commonly used AgTech, builds on the information provided by satellite technology to guide precision ploughing, seeding, and fertilising for optimal productivity.

In fifth place are Drones, which these days do everything from monitoring crop and horticultural health, and readiness to pick or harvest, to monitoring remote stock water troughs and even mustering.

Rounding out the top six most common forms of AgTech are Remote sensors, which gather myriad farm data — from soil wetness to pasture problems — and can be simply controlled from a smartphone.

A.I. Tool Kits are fast becoming an everyday thing on a lot of farming enterprises and work in unison with all the above, especially from an Education point of view.

Benefits of Agricultural Technology (AgTech) for farmers

AgTech has many diverse benefits, from time and cost efficiencies to identifying and providing solutions across a wide array of challenges faced by our farmers.

According to farmers themselves, the top benefits of AgTech include less wastage, the ability to diagnose issues remotely, reduced labour, better understanding of new opportunities and solutions, more accurate and better record keeping, the ability to closely monitor large areas, better livestock management, increased profitability, reduced input costs, and a reduction in wastage.

High cost and the lack of information are the main barriers to the adoption of AgTech for farmers

The high cost of Agricultural Technology is mentioned by two-thirds (66%) of farmers as the main barrier to the adoption of AgTech – almost double any other reason cited.

Simply not knowing enough about AgTech and the capabilities of these technologies is mentioned by 37% of farmers who ‘don’t know enough about it’ while 36% of farmers mentioned ‘poor connectivity’ to the Internet and telephone networks as a barrier to adoption.

Almost a quarter of farmers (23%) mentioned they have ‘No need for it’, and almost one-in-five (19%) say they believe there is only a ‘low benefit’ to adopting AgTech.

Other barriers for the use of AgTech mentioned by farmers include ‘Too much regulation’ (13%), ‘I don’t trust technology’ (7%), ‘There have not been any barriers’ (5%), and just being ‘Time poor’ (3%).

It’s important to remember when considering these barriers to the adoption of Agricultural Technologies that 89% of Australian farmers currently use, or have at some time used, farm technology, so the barriers, while important, are standing in the way of only a small cohort of farmers.

Barriers to adoption of Agricultural Technology (AgTech) mentioned by Australian farmers

Source: Roy Morgan Farmer AgTech Survey April-May 2024. Base: Australian farmers 18+ n=1,001.

Roy Morgan CEO Michele Levine says Agricultural Technologies, ‘AgTech’, are transforming the farming experience like never before, with the proliferation of new technologies driving time and cost savings for Australian farmers all around the country:

“Roy Morgan’s special Roy Morgan Farmer Agricultural Technology Survey this year shows that Australian farmers are amongst the world’s most ‘tech savvy’ – 89% say they have already used, or would consider using, AgTech on their farms.

“In fact, over seven-in-ten farmers (72%) are currently using AgTech to drive time and cost savings in their businesses and reaping the benefits offered by the array of new technologies that are increasingly coming onto the market.

“The most widely used AgTech is ‘Farm management software’ which covers everything from paddock mapping to animal genetics, feed inventory, water monitoring, and biosecurity planning.

“Other prominent AgTech includes ‘electronic ID tags’, ‘satellite technology’, ‘precision farming’, ‘drones’, and ‘remote sensors’, which provide detailed information to drive innovation and cost efficiencies throughout the farming environment.

“However, there are still barriers to adoption for many farmers that should be understood when considering how to drive greater uptake of these varying technologies, including among those farmers who have yet to take the step and adopt AgTech.

“The most commonly mentioned barrier – by 66% of farmers – is the ‘high cost’ surrounding many of these technologies. What is interesting to consider is that although ‘high cost’ is considered a barrier to adoption, cost savings are considered one of the main benefits for farmers who have taken the step and adopted AgTech.

“There is surely a way to ‘thread the needle’ here and find a way to reduce the entry costs to be able to reap the benefits of the technology post-adoption.

“Many other farmers cited lack of information about various AgTech products as well as their perception that they ‘have no need for it’ or that it would be of ‘low benefit’ in their case.

“These barriers to adoption appear to be mainly rooted in not understanding how exactly AgTech could improve the farming experience for these respondents. Businesses at the leading edge of AgTech may require a more targeted approach to reaching out to these farmers to find out what challenges they face and how the latest technologies could assist the growth of their business.

“When asked unprompted about which brands farmers associate most with Agricultural Technologies, our survey of over 1,000 farmers mentioned John Deere in first place, followed by Gallagher and Elders rounding out the top three.”

With well-established companies expanding their services in the AG Tech space area like REALM Group TECH

The biggest challenges for farmers currently

REALM Group TECH - (A.I. Farmers Tool Kit ) [email protected] Built by Farmers Powered By A.I.

Brands most associated with AgTech*

AgTech Use, and Intention to Use

Types of AgTech used

Benefits and barriers to adopting AgTech

What farmers would like the government to do to facilitate AgTech adoption

How well farmers feel that governments, government departments, and industry bodies understand farming

Farmer business confidence

Agribusiness media readership

Agribusiness finance products

Analysis overall, as well as by farm type, size, revenue, and state

*AgTech brands mentioned: REALM Group TECH, Ag Leader, AgriWebb, Agworld, Allflex, Bayer, Case, DeLaval, Elders, Farmbot, Gallagher, John Deere, Lely Australia, Mobble, MLA/Meat and Livestock Australia, Nufarm, Nutrien Ag Solutions, Optiweigh, SwarmFarm Robotics, Topcon, Trimble, and Tru-Test.

For Sale Listings (List it for FREE!)

Inputs and Commodities

Australia agribusiness August 2025: Seasonal conditions improve

Australian agricultural inputs in August 2025 showed regional variability, with some areas seeing good pasture growth but others facing low pasture growth and potential reliance on supplemental feed. Soil moisture levels were a concern in parts of southeastern Australia due to recent dry conditions. However, the overall outlook remained positive, with a high-value cotton crop, strong beef and lamb markets, and an increase in Western Australia's planted crop area. Input costs, such as for fertilisers, remain a point of concern due to reliance on imports.

Climate and Pasture Conditions

Variable Rainfall:

Rainfall was highly variable in August 2025, with parts of Western Australia and Queensland receiving good falls, while southern New South Wales remained largely dry.

Soil Moisture:

Dry conditions in parts of southeastern Australia, particularly New South Wales and Victoria, were leading to declining soil moisture levels.

Pasture Growth:

Pasture growth was strong in northern and eastern Australia, but low in northern Victoria, South Australia, Western Australia, and southern New South Wales, necessitating continued supplemental feeding in those regions.

Crop and Livestock Outlook

Winter Crops:

The Australian Crop Report forecast a decline in crop production for 2025–26 due to lower expected yields offsetting an increase in planted area, especially in Western Australia.

Cotton:

Despite potential challenges, the Australian cotton industry was on track for another strong season with a high value proposition for growers.

Beef and Lamb:

The beef market was strong and expected to carry momentum into 2025, with record highs expected for lamb and mutton as well.

Input Costs and Trends

Fertiliser Dependency:

Australia's reliance on imported nitrogen-based fertilisers continues to be a concern, highlighting the need for domestic production capabilities.

Increased Production Costs:

Input costs, including for fertilisers, seeds, and fuels, were higher in some regions, contributing to increased production costs for farmers.

FutureAg Expo:

The FutureAg Expo, held in Melbourne in early August 2025, showcased innovations in agricultural inputs, including digital assistance, precision farming systems, and bio-transformation technologies, according to IFW-expo.

Thanks, ROBO

Featured Auction Listings

RGA - REALM GROUP AUSTRALIA - MULTI-VENDOR MACHINERY AUCTION, AUSTRALIA WIDE

We’re now taking listings for our next up-and-coming auction.

Contact us today!

AG NEWS AUSTRALIA

Fonterra sells Consumer business to Lactalis for $3.5b

More than a year after Fonterra Co-operative Group raised the prospect of divesting its global Consumer and associated businesses, it has agreed to sell them to the global French dairy giant, Lactalis, for AU$3.479 billion (NZ$3.845 billion).

There is also potential for an extra $339 million (NZ$375 million) from the Bega licences held by Fonterra’s Australian business.

The sale includes Fonterra’s global Consumer business (excluding Greater China) and Consumer brands; the integrated Foodservice and Ingredients businesses in Oceania and Sri Lanka; and the Middle East and Africa Foodservice business.

Fonterra CEO Mike Hurrell said that Lactalis – as the largest dairy company in the world – had the scale to take the brands and businesses “to the next level”.

“Fonterra farmers will continue to benefit from their success, with Lactalis to become one of our most significant Ingredients customers.

“At the same time, a divestment of these businesses will allow Fonterra to deliver further value for farmer shareholders and New Zealand by focusing on our world-leading Ingredients and Foodservice businesses, through which we sell innovative products to more than 100 countries around the world, from our home base here in New Zealand,” Hurrell said.

Before its completion, there are customary financial adjustments and conditions required – approval by farmer shareholders, separating the businesses from Fonterra, and receipt of certain final regulatory approvals.

Hurrell said the co-op’s FY25 earnings guidance of 65-75 cents per share remained unchanged. The co-op is targeting a tax-free capital return of NZ$2.00 dollars per share, which is approximately NZ$3.2 billion, following completion of the sale.

As part of the sale agreement, Fonterra will continue to supply milk and other products to the divested businesses

Fonterra chair Peter McBride said over the last 15 months, the board has thoroughly tested the terms and value of both a trade sale and initial public offering (IPO) as divestment options.

In February 2024, Fonterra merged its Australian and New Zealand businesses into Fonterra Oceania. Three months later, Hurrell announced a “step-change” for the business to focus on becoming a global B2B dairy nutrition provider. As a result, it would divest some or all of its global consumer business – including Fonterra Oceania.

In February, Hurrell said the group was considering either a sale or an initial public offering (IPO) and announced a rebranding of the consumer business to Mainland Group. Its MD Global Markets Consumer and Foodservice, René Dedoncker, was named CEO-elect. Dedoncker led the Australian business from 2017 through the merger.

And in March, the roadshow got underway.

McBride said the sales process had been “highly competitive with multiple interested bidders”, and the board was confident Lactalis was the highest value option for the co-op, including over the long term.

“Alongside a strong valuation for the businesses being divested, the sale allows for a full divestment of the assets by Fonterra, and a faster return of capital to the co-op’s owners, when compared with an IPO.

“This, coupled with the firm belief we have in Fonterra’s long-term strategy, gives the board the confidence to unanimously recommend this divestment to shareholders for approval,” McBride said.

Lactalis submitted an informal clearance to bid with the Australian Competition & Consumer Commission (ACCC), which announced in July it wouldn’t oppose Lactalis’ proposed acquisition of Fonterra’s consumer and food service businesses, if the bid went ahead. While it would see two of the largest buyers of raw milk combine, the ACCC says it is “unlikely” to result in a lessening of competition.

Lactalis CEO Emmanuel Besnier said the acquisition would “significantly strengthen our strategy across Oceania, Southeast Asia and the Middle East”.

“Combining the Fonterra consumer business operations and market-leading brands with our existing footprint in Australia and Asia will allow Lactalis to further grow its position in key markets. I'm delighted to become a key partner to Fonterra over the long term as well, and I'm looking forward to welcoming new teams to the Lactalis family,” Besnier said.

Fonterra received financial advice from Jarden, Craigs Investment Partners, and JP Morgan; and legal advice from Russell McVeagh and Herbert Smith Freehills Kramer.

Fonterra’s previously announced FY25 earnings guidance of 65-75 cents per share remains unchanged, and its FY26 earnings guidance will be announced as part of the FY25 Annual Results in September 2025.

“The Co-op expects its FY26 earnings per share to be presented on a continuing operations basis and exclude the performance of the Consumer and associated businesses during the pre-completion period,” Hurrell said.

With the Special Meeting to occur in late October or early November, Fonterra has deferred its Annual Meeting from November 2025 to December 2025. A date for the Annual Meeting will be announced in due course.

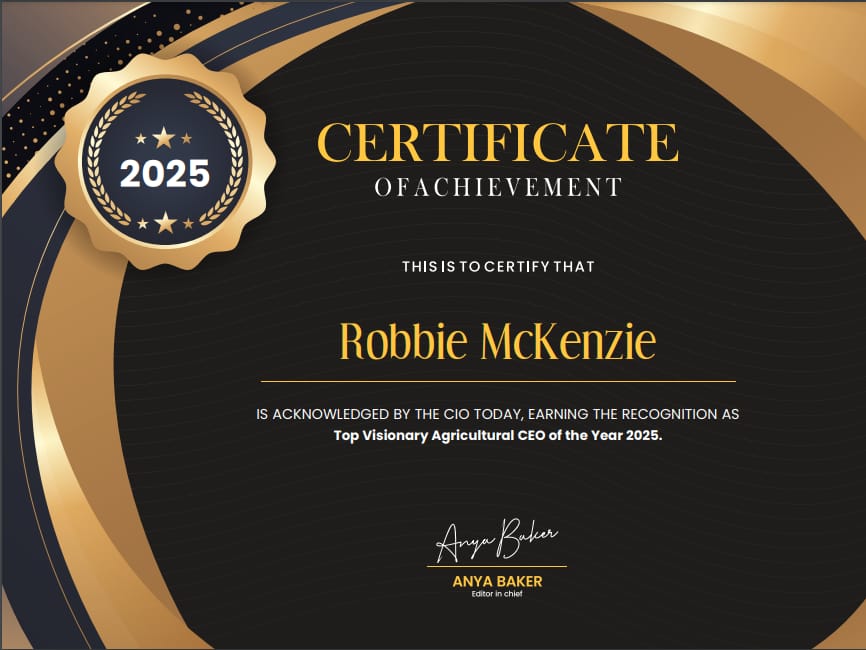

THE CIO TODAY AWARD

TOP VISIONARY AGRICULTURAL CEO OF THE YEAR 2025

Simply click www.payintime.com.au to provide your details, and we will be in touch. It all starts with one phone call.

YOUR TOWN

We Have Been to Your Town! We don’t just sit in an office; we are hands-on with our Farmers! 🙌

Please email us with a picture of yourself or a family member in front of your TOWN-SIGN to [email protected]

Welcoming Jamie Ramage ( Ramage Digital )

A Strategic Long-Term Venture with REALM Group Australia

Building a Low-Friction Future for Livestock Transactions

The livestock industry has taken major steps into the digital era. Online platforms now make it possible to list, bid, and transact animals from anywhere in the country. But while the infrastructure is modernising, the real bottleneck isn’t the click of a mouse—it’s everything that happens around the transaction: trust, financing, and transparency.

For decades, producers, agents, and processors have worked within a system shaped more by tradition than technology. Prices are still influenced by guesswork. Capital is tied up in slow-moving systems. Valuable performance data is often locked away in silos. That friction costs everyone—farmers miss opportunities, processors face supply uncertainties, and the broader industry falls behind global counterparts.

Finance at the Point of Sale

Now imagine this: every livestock listing displays not only breed and weight, but also real-time financial options embedded directly into the transaction. A farmer unlocks working capital the moment a sale is made—no more waiting weeks for settlement. A processor forward-contracts with confidence, securing consistent throughput. Market signals become immediate and meaningful, shaping decisions across the supply chain.

This isn’t speculation. In other industries, embedded finance is already streamlining transactions and improving liquidity. In agriculture—where margins are tight and timing matters—embedding finance into digital livestock sales could be the unlock the industry needs.

Beyond Agents vs Platforms

This isn’t about replacing agents. Agents bring critical expertise and relationships that remain central to the livestock trade. What’s changing is the operating environment around them.

When finance and transparency tools are built into the platforms agents and producers already use, everyone benefits. Agents gain new tools. Producers gain confidence. Processors gain real-time insight. The whole system becomes more coordinated, more resilient, and less reactive.

A System That Moves at the Speed of Trust

For too long, the livestock sector has responded to volatility like a paramedic at a crash scene—patching up problems only after the damage is done. A more transparent, finance-enabled, digital ecosystem would let us move upstream: identifying risks, seizing opportunities, and making decisions based on data, not instinct.

The future isn’t just digital—it’s low-friction. A system where each transaction carries not just a price, but trust and liquidity. Where data, capital, and animal movement are synchronised. Where everyone in the chain—from producer to processor—can act faster, with more confidence.

This is the opportunity in front of us: to build a livestock market that moves at the speed of trust.

About the Author: Jamie from RD Creative Studio

RD Creative Studio is a regional branding and digital strategy studio working at the intersection of agriculture, design, and strategy. As a partner to REALM Group, RD Creative helps rural businesses build clarity and momentum across brand, content, and communication.

Want to connect or learn more?

Women in Ag

Welcoming Amanda Burchmann – A Strategic Long-Term Venture with REALM Group Australia

Right Stock, Right Environment: Why Genetics Counts in Livestock Production

I’m excited to share my latest article, now published on JAB Agri Solutions:

👉 Breeding Livestock for Australian Conditions: Why Genetics & Climate Matter

Choosing the right livestock breed isn’t just about looks or tradition—it’s a decision that impacts animal health, productivity, and long-term success.

In this article, I explore:

✅ Why matching the right breed to your environment matters

✅ How decades of targeted breeding have shaped resilience and productivity

✅ Practical benefits for producers—from lower vet bills to better animal welfare

Whether you’re managing a small farm, hobby block, or commercial enterprise, understanding genetics and environment is essential for building healthier, more productive herds and flocks.

🔗 Read the full article here - www.jabagrisolutions.com.au/knowledge/breeding-livestock- for-australian-conditions-why-genetics-amp-climate-matter

I’ve also included a list of useful resources, tools, and courses at the end of the article to help guide your breeding and livestock decisions.

As always, my goal is to provide practical, trusted information to help producers—big and small—make confident, sustainable choices.

Until next week —Let’s build a lifestyle we all love, the right way.

Kind Regards,

Amanda Burchmann

Livestock Production & Industry Development Specialist

Founder | Advocate | Producer

📞 0408 847 536

📧 [email protected]

🌐 www.jabagrisolutions.com.au

“Samantha Watkins Photography”

REALM Group Australia is proud to sponsor amateur photographer Samantha Watkins. We've seen her photography skills grow tremendously over the years, and we believe it's the perfect time for her to step into the photography world.

Click on the link to take you to her FB photography page, where you can see her beautiful photos.

It is called "Samantha Watkins Photography" https://www.facebook.com/profile.php?id=61573116870308

Samantha Watkins's sample photography.

All photos are available for purchase – simply email [email protected]

And she will be happy to assist you.

Active & Upcoming AUCTION!

(Under Auction Listings)

Let us know what you have to sell or auction - it’s FREE to List, and FREE to advertise. Please email [email protected]

Let us help you with your financial needs. Click Here www.payintime.com.au

Let us help you with your financial needs. Click Here www.payintime.com.au

— Robbie McKenzie

Realm Group Australia

REALM Group Australia (RGA) - originally est. 1992. The most trusted online Ag Marketing System in Australia. Built by Farmers for Farmers! Education is the KEY. True Pioneers - We were the first, and we are still growing. Proud Supporters of the Royal Flying Doctor Service (RFDS) & Ronald McDonald House Charities (RMHC)