F E A T U R E D

ARTICLE 916

Cattle breeder awarded $52m after successful appeal against mine owner

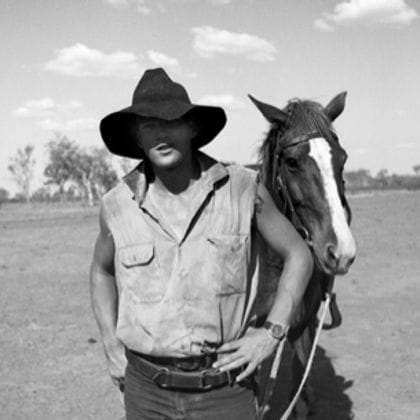

James Gorman's companies purchased Vermont Park in 2009 and Seloh Nolem in 2015. (ABC News: Christopher Gillette)

In short:

Pembroke Olive Downs has been ordered to pay the owner of two grazing properties in central Queensland more than $52 million in compensation.

The dispute centres on a proposed mine expansion to the south-west of the cattle operations.

What's next?

Both parties will make submissions about the cost of the appeal.

A Queensland landholder has been awarded more than $50 million in compensation for a coal mine expansion that will drastically reduce the size of his cattle properties.

James Gorman challenged a Land Court ruling that ordered Bowen Basin miner Pembroke Olive Downs Pty Ltd to compensate him $34.8 million for the Olive Downs open-cut mine expansion on two of his properties.

In a judgement handed down on Tuesday, Justice Graeme Crow of the Land Appeals Court allowed the appeal and ordered the compensation to be increased to more than $52.8 million.

In the judgement, Justice Crow found the calculations used to determine the original compensation did not consider all the variable costs of running and maintaining a sizeable cattle property.

The Isaac River, which fronts a large section of the Vermont Park property. (ABC News: Christopher Gillette)

The two properties, Vermont Park and Seloh Nolem, span more than 25,000 hectares south-west of Moranbah.

The land is used for cattle breeding and is owned by companies of which Mr Gorman is the sole director.

The judgement reasoned that metrics such as the property's cattle-carrying capacity and its susceptibility to floods were erroneously used in the original December judgement to determine the value of the properties.

It also highlighted the irregular shape the property would assume if the mining lease were approved.

The area of the lease proposed by Pembroke Resources. (Supplied)

But the judgement upheld an earlier rejection of Mr Gorman's attempt to include the cost of agistment into the final compensation figure.

Justice Crow recognised that "all but certain a high premium" would need to be paid to find replacement land for the cattle while mining occurred on the property, given there was little suitable available land in the region.

Queensland Resources Minister Dale Last said the judgement reflected the need for miners to comply with the conditions of their existing leases.

He said rehabilitation technology had improved in recent years.

"I make this point regularly — they're pulling this resource from the ground and, by the same token, when they're finished, we want that land returned to its natural state," Mr Last said.

Queensland Resources Council said in a statement that the sector had "a long history of constructively engaging with landholders to ensure the best outcomes for all parties".

Both parties will make submissions about the cost of the appeal.

Pay In-Time Finance

Dry Seasons Deepen, Debt Climbs & Carbon Farming Takes Center Stage

The dry across southern Australia is no longer just a worry—it’s hitting farm finances in a real way. In many parts of Victoria, South Australia, and Tasmania, soil has had just enough moisture to look green, but not enough to grow the feed livestock need. Farmers are spending much more than usual on imported fodder and travel costs, just to keep stock fed. The ongoing gap in rainfall is snapping at supply chains and forcing early decisions that affect recovery next year. (― taken from recent climate and drought impact reports)

Meanwhile, debt is rising. Recent data shows that the farm lending sector grew by about 6% year-on-year in 2023-24, pushing the total outstanding loans close to $131.4 billion. The growth isn’t uniform: farms in Western and South Australia saw the fastest rise, while many smaller producers remain largely debt-free. But for those carrying loans, the pressure is real—interest costs, repayments, and servicing debt are taking up more of annual income in many cases.

At the same time, investors and platforms are leaning into carbon farming. A big deal struck this week saw the Meldora platform buy a large property aggregation in Queensland with plans to produce carbon credits alongside traditional cropping and grazing. It’s becoming clear that sustainable practices aren’t just policy talking points—they’re becoming parts of farm finance models themselves.

What Farmers Should Be Thinking Right Now

These trends suggest a few shifts worth acting on:

If you’re carrying debt, now’s a chance to review terms. Rising costs mean that loans that seemed manageable last season could strain cash flow this one.

Consider ways to diversify income. Carbon credits, ecological restoration, or mixed land use may offer buffers against dry years or market swings.

Be wary of feed cost exposure and supply chain risks. Early planning, bulk purchasing, or arranging flexible financing for feed and water resources could save a lot when drought worsens.

How Pay In Time Finance Can Help You Navigate This Moment

At Pay In Time Finance, we’re focused on helping farmers turn stress into strategy. Here are the kinds of practical help we’re delivering:

We structure loan packages that ease repayments during lean periods, not just harvest windows.

We help explore finance options that back sustainable land use or environmental credits—so your farm can reap rewards from more than just crops.

We assist with refinancing debt, especially where current terms are biting hard, to free up cash for pressing needs like feed, water, and infrastructure.

WEEKLY AUCTION DATES – 2025

1.) 12th September 2025 2.) 3rd October 2025

INPUTS

Australian agriculture in 2025 sees projected rises in farm profits and export values, driven by strong livestock prices and increasing farm business income, though crop production is expected to see a slight fall in value despite strong growth in certain pulse crops. Inputs like nitrogen are heavily reliant on imports, but there's a trend toward eco-friendly inputs, and increasing farm-level technology and AI integration are expected.

Key Inputs & Costs

Nitrogen (Urea):

Australia remains entirely reliant on imported urea for nitrogen fertilizer due to high domestic operating costs, primarily linked to natural gas prices.

Technological Inputs:

Artificial intelligence (AI) is expected to significantly transform the sector, supporting everything from production planning and marketing to input pricing and security.

Eco-Friendly Inputs:

There is a growing trend towards more sustainable inputs, such as those that support groundwater protection and reduce phosphorus, with a focus on achieving measurable environmental outcomes.

Sector Overview

Value & Profits:

The gross value of agricultural production was forecast to rise, with strong livestock prices driving higher farm business profits.

Crop Production:

While winter crop production remained above average, overall crop production value was expected to fall slightly in 2025-26.

Livestock:

Strong global demand and rising restocking activity supported higher prices for livestock and livestock products.

Market Dynamics & Trends

Export Demand:

Demand for Australian beef and horticulture remained strong, with opportunities for growth.

Trade:

The global canola market experienced shifts with increased Canadian supply and changes in access to the Chinese market.

Farm Profitability:

Farm financial performance was expected to improve for Broadacre farms, with higher crop and livestock receipts and potential easing of some input costs.

Finance:

Banks played a critical role in supporting the sector, with a focus on aligning loan terms with seasonal cash flows and navigating market shifts.

AG MACHINERY

Case IH unveils 785 Quadtrac, its most powerful tractor yet, at Farm Progress Show

Paying homage to Steiger’s iconic legacy, the one-off lime green 785 Quadtrac can’t be missed in front of Case IH’s booth at this year’s 2025 Farm Progress Show in Decatur, Ill. It’s an eye-catching color, which accentuates the ag machinery brand’s new flagship tractor from the other red machines at Lot 867, and is befitting of Case IH’s most powerful tractor yet.

“The 785 builds on what we have currently for a Steiger offering, taking it to that next level,” says Mark Burns, Case IH’s marketing manager for four-wheel machines in North America, about Steiger’s seven other models. Boasting 785 rated and 853 peak hp, it has roughly 10% more power than the 715 Quadtrac.

TURNING HEADS: This one-off lime green 785 Quadtrac pays homage to Steiger's iconic design while showcasing Case IH's most powerful tractor to date, with 853 peak hp. The machine can be seen in person at the 2025 Farm Progress Show in Decatur, Ill., at Case IH Lot 867. PHOTOS BY ANDY CASTILLO

CUSTOM DETAILS: Custom green stitching adorns the specially made 785 Quadtrac's seat, one of many details in this tribute machine that blends Steiger heritage with modern power and comfort. The green version is not available for purchase.

The new 785 takes the top spot in the Steiger lineup. Externally, it looks similar to other Steigers and has the same PTO specifications as the 715. But internally, the tractor is completely redesigned to maximize power output from its 16-liter FPT engine.

“There's a change to the fuel injectors. There's a change to the pistons and rings. There’s a change to the oil flow to the bottom of the piston for not only lubrication but also cooling. There’s a new engine data set altogether,” Burns says.

Power upgrades

Given its immense power, engineers upgraded the transmission, beefed up the axles, and enhanced the differential assembly. The SCR-only emission system has also been simplified to “keep the engine design simple and allow the engine to focus on producing power while emissions are treated after the engine system.”

Inside the cab, the 785 features free connectivity and Case IH’s latest tech, like end-of-row AutoTurn, real-time inter-machine data sharing, and FieldOps.

"For model year 2026, we made a few creature comfort tweaks. You'll notice a new post on the right-hand side. There's an additional set of foot pegs [on the A post,]” he says. This makes it more comfortable when the seat is swiveled.

In-field power

Practically, Burns says the machine was built with forward-looking design elements. Its high-power output and internal tech are future-proofed to meet the evolving needs of modern agriculture.

For example, a 40% torque rise provides substantial power reserves for demanding conditions, and the fuel injection and piston upgrades support that higher power output. It’s capable of pulling the largest implements on the market, including 41-foot high-speed discs at 10-plus mph, massive air seeders, and seed tanks. And it maintains speed while powering implements through deep compaction.

PRIORITIZING COMFORT: Inside the 785 Quadtrac's cab, upgraded creature comforts include a redesigned right-hand post and additional foot pegs on the A post, making swiveled-seat operation more comfortable for long days in the field. Pictured is the custom version, which was unveiled at the Farm Progress Show.

Big picture, the new 785 embodies Case IH’s focus on combining immediate practical improvements with forward-looking technological innovation. Kurt Coffey, head of marketing for Case IH Global, says the brand is trying to optimize the power and efficiency of existing equipment platforms.

“We're continuing to invest in optimizing the performance of our existing platforms,” says Kurt Coffey. As we move forward, the American farmer can compete and win. So we’re investing in what products will make them continue to be able to compete on a global basis.”

Striking paint scheme

Unfortunately for those excited about a retro Steiger throwback, the new machine only comes in Case IH red. The green machine, which features details like founder Douglass Steiger’s signature on the cab above the step and green seat stitching, is an exclusive Farm Progress Show special. Burns says it’s a nod to the past while showcasing the brand’s present.

“Using innovation and entrepreneurship, [the Steiger family] built what they needed. It’s well-known for power. It's well-known for performance. That was what we were trying together. The 785 really embodies all those features,” Burns says.

The new 785 comes with a three-year, 2,000-hour warranty. For more information, visit caseih.com. The green Steiger can be viewed up close at this year’s Farm Progress Show at Case IH Lot 867.

IMPRESSIVE POWER: The production 785 Quadtrac in signature Case IH red delivers 785 rated hp and a future-proofed design, ready to pull the largest implements on the market.

For Sale Listings (List it for FREE!)

Featured Auction Listings

RGA - REALM GROUP AUSTRALIA - MULTI-VENDOR MACHINERY AUCTION, AUSTRALIA WIDE

We’re now taking listings for our next up-and-coming auction.

Contact us today!

AG NEWS AUSTRALIA

Agtech Seedlings: Bonsai Robotics secures $15M to advance automated fruit harvesters

Also in this week’s farm technology news: CH4 Global begins large-scale production of methane reduction feed additives, and an indoor greens grower expands and rebrands.

Bonsai Robotics Co-Founders Ugur Oezdemir and Tyler Niday are with their autonomous robot in an orchard.

Bonsai Robotics raises $15M for AI to help farms combat labor shortages

Bonsai Robotics raised $15 million from investors to advance production of its automated harvester Visionsteer, which uses artificial intelligence to pick fruits and nuts in orchards.

The recent funding will be used to enhance Bonsai’s software and expand the startup’s artificial intelligence platform and data set, according to a news release. The San Jose, California-based firm also plans to build its partnerships with manufacturers and farmers, as well as accelerate bringing its products to market.

“This additional funding is strong validation of the incredible work our team has accomplished and our future growth prospects,” Tyler Niday, Bonsai co-founder and chief executive officer, said in a statement.

Bonsai’s flagship Visionsteer is a retrofit hardware kit that uses cameras and computers to make existing farm equipment operate autonomously. The company has conducted field trials with more than 40 farm vehicles integrated with the computer-vision technology across the U.S. and Australia.

Bonsai secured $13.5 million in early funding to accelerate production by making investments in hiring, sales, and marketing. The latest funding round was led by Bison Ventures, with participation from Cibus Capital, Acre Venture Partners, and other investors.

CH4 Global begins large-scale production of methane-reducing cattle feed additive

CH4 Global on Wednesday began production of red seaweed at its cultivation pond in Louth Bay, Australia, in an effort to scale the feed ingredient for methane reduction in livestock.

As competitors rely on ocean harvesting or expensive indoor tanks for Asparagopsis production, CH4 Global’s pond-based system has a host of advantages, according to the release, including cost savings of up to 90% and reduced contamination and weather risks.

The company’s new EcoPark facility has the capacity to produce more than 80 metric tons of Asparagopsis seaweed per year at a fraction of the cost that competitors face, which the company said allows it to pass the savings on to customers and ensures the profitability of its flagship product, Methane Tamer.

“We’ve cracked the code on making methane-reducing feed supplements commercially viable without requiring government subsidies — a crucial step in scaling this important climate solution,” CH4 Global’s CEO and Co-Founder Steve Meller said in a statement.

Currently, the EcoPark facility has 10 cultivation ponds with a combined capacity of 2 million liters. Plans are in the works to expand to 100 cultivation ponds over the next year, and with enough investment, eventually 500.

CH4 Global, based in Henderson, Nevada, recently said it will partner with Mitsubishi Corporation to grow sales and expand its Methane Tamer cattle feed supplements across Asia-Pacific markets.

Indoor lettuce grower rebrands as Nimble Farms with expansion in the Northeast

A Buffalo, New York-based indoor farming company formerly known as Ellicottville Greens has rebranded itself as Nimble Farms as it expands into markets across the Northeast.

Nimble Farms, established in 2018, uses climate-controlled shipping containers that have been converted to grow leafy greens, herbs, microgreens, and mushrooms indoors with renewable energy sources. The company has collaborated closely with local grocery stores, schools, and hospitals to meet demand for local, perishable produce.

As part of the rebrand, Nimble Farms said it has partnered with Tops Friendly Markets to bring its Butterhead lettuce to all 152 supermarket locations across New York, Pennsylvania, and Vermont.

Nimble Farms, which has three growing sites in New York, has plans to double its operational footprint by the end of the year, with the ultimate goal of building 100 locations nationwide over the next decade.

As Nimble Farms looks to ramp up expansion, Bowery Farming and other indoor vertical farms have struggled with overhead costs and securing investments, leading to closures and setbacks.

“With demand for healthy, perishable produce higher than ever, and with ongoing challenges facing our fresh food supply, we look forward to scaling our impact both regionally and nationwide in the years to come,” Gabe Bialkowski, CEO of Nimble Farms, said in a statement.

Simply click www.payintime.com.au to provide your details, and we will be in touch. It all starts with one phone call.

YOUR TOWN

We Have Been to Your Town! We don’t just sit in an office; we are hands-on with our Farmers! 🙌

Please email us with a picture of yourself or a family member in front of your TOWN-SIGN to [email protected]

Welcoming Jamie Ramage ( Ramage Digital )

A Strategic Long-Term Venture with REALM Group Australia

Feeding to Market Specs

Why Quality Feed Conservation is the Competitive Edge That Actually Pays

Across Australia, producers are staring down dry seasons with familiar tension. Paddocks are bare. Prices for hay and silage are creeping up. And once again, the question hangs in the air: who’s going to make it to market, and who’s going to be forced to sell early?

In years like this, the conversation shifts. It's not just about getting stock through a season. It’s about meeting specs.

Carcase weight. Fat cover. Evenness. Premium programs demand all three. But behind every high-performing line is the same quiet force: conserved feed that’s been handled properly from the start.

Retain, Finish, Compete

Once, the fallback was to offload lambs or calves as stores when the feed ran short. That’s still happening, but something is changing. More producers are choosing to retain and finish. Why? Because they know what’s waiting on the other side.

Meeting specs isn’t luck. It’s feeding to plan. The producers who win are the ones who understand that conserved feed is not just insurance. It’s leverage.

Good Feed Isn’t a Backup Plan. It’s the Margin.

A well-made bale of silage doesn’t just prevent weight loss. It delivers growth rates that keep animals in spec and on schedule. It narrows the window to finish. It gives processors what they need. And when the quality drops? That’s when margins bleed.

Spoilage. Heat damage. Leaf loss. It all adds up. Not just in feed cost, but in animals that don’t finish, orders that don’t get filled, and premiums that quietly slip away.

The Producers With Hay in the Shed Are Still on the Truck

This year’s fodder market has been a case study in volatility. Prices have surged in the south. Freight costs are creeping in. Those who conserve early aren’t just saving money. They’re still selling. They’re still meeting specs while others are forced to step back.

Processors and agents have noticed. Rainfall forecasts used to be the main signal. Now they’re watching on-farm feed reserves just as closely. In tight years, feed is the difference between participating and missing the opportunity entirely.

What’s Under the Wrap Matters

It’s easy to focus on what’s in the paddock. But the real advantage often comes after the baler leaves.

Producers working with the right advisors are lifting the standard on every bale. Companies like Tama are supporting this shift with gear and guidance that protects feed value, not just presentation. Better wrap, better net, smarter systems. It all shows up when the feed is opened and the animals perform.

This isn’t just an equipment conversation. It’s a systems conversation. The better the feed, the more confident the program.

The Future Looks Like This

In a variable climate, flexibility becomes a form of power. The producers who can grow, conserve, and allocate high-quality feed aren’t just surviving. They’re trading on their own terms.

They’re selling when the price is right. They’re meeting specs when others fall short. And they’re doing it with fewer unknowns in the system.

As one agent put it:

The ones with hay in the shed are still on the truck.

Women in Ag

Welcoming Amanda Burchmann – A Strategic Long-Term Venture with REALM Group Australia

Suggested Upkeep for Your Livestock Property

Running a livestock property isn’t just about the setup – it’s the ongoing upkeep that protects your animals, investment, and compliance. Here are the key takeaways:

✔Lock Up & Safety – Secure sheds, gates, and gear. Keep working areas clear.

✔Fencing & Boundaries – Maintain stock-proof fences; they’re also vital for biosecurity.

✔Water Access – Ensure livestock have reliable, clean water, especially in dry periods.

✔Oversight When Away – Arrange a neighbour or sitter to check the property and stock.

✔Record Keeping – Track treatments, feed (with CVDs), chemicals, and movements for LPA/NLIS compliance.

✔Plans in Place – Develop a Biosecurity Plan, Animal Welfare Plan, and keep a Visitor Register.

✔Safe Chemical Storage – Lock away, label, and record for audits.

✔Weed & Pest Control – Act early, monitor regularly, and coordinate with neighbours.

👉 Helpful contacts: Local vet, biosecurity officers, ag stores, neighbours, and your insurance/finance providers.

Final Thought: Consistent upkeep ensures animal welfare, smooth audits, and long-term property sustainability and better return on investment.

Read the full article here: Suggested Upkeep for Your Livestock Property & Best Practices

Until next week —Let’s build a lifestyle we all love, the right way.

Kind Regards,

Amanda Burchmann

Livestock Production & Industry Development Specialist

Founder | Advocate | Producer

📞 0408 847 536

📧 [email protected]

🌐 www.jabagrisolutions.com.au

Welcoming Simon Cheatham – RINGERS FROM THE TOP END with REALM Group Australia

Simon Cheatham- RINGERS FROM THE TOP END (RFTTE)

It's been just over a year since the cattle station community lost two passionate helicopter pilots, Peter Ritter and Gavin U’Ren, in a tragic accident whilst on a mustering job south of Derby, WA.

Their good mate Jack Poplawski, Chief Pilot at Fortescue Helicopters in Newman, WA, reached out this week with news that Graydn Doak - Owner and Operator of Jandakot Heli-Co in Perth and another close friend of Pete and Gav - has launched an annual scholarship in their honour.

So I'm only too pleased to share the annual Ritter-U’ren Scholarship. Founded in memory of two pilots who loved the agricultural aviation sector and inspired so many.

This scholarship supports junior pilots pursuing an ag-aviation career with either a Low-Level Rating or 5 hours of Advanced Emergency Training in our R22 or R44 (weight-dependent). All helicopter, instructor, and examiner costs are included. Training will be conducted at Jandakot Heli-Co in Perth, WA.

Why does this matter? Agricultural pilots are the ringers of the sky - they work tirelessly to keep cattle stations running with those on the ground, often in tough and dangerous conditions. This scholarship keeps Pete and Gav’s legacy alive while investing in the next generation of skilled pilots.

VIEW VIDEO AND APPLY (link to https://rfttejobs.com/blog/ritter-u-ren-scholarship-honouring-two-legendary-ag-aviation-pilots/)

The winner will be drawn from a hat on the 1st October 2025. Please share this newsletter so more aspiring pilots hear about this opportunity.

Hooroo for now,

Simon Cheatham

0417 277 488 | [email protected]

Founder | Ringers From The Top End | RFTTE.com | The Online Campfire since 2007

RFTTE PTY LTD | ABN 29 678 593 283

“Samantha Watkins Photography”

REALM Group Australia is proud to sponsor amateur photographer Samantha Watkins. We've seen her photography skills grow tremendously over the years, and we believe it's the perfect time for her to step into the photography world.

Click on the link to take you to her FB photography page, where you can see her beautiful photos.

It is called "Samantha Watkins Photography" https://www.facebook.com/profile.php?id=61573116870308

Samantha Watkins's sample photography.

All photos are available for purchase – simply email [email protected]

And she will be happy to assist you.

Active & Upcoming AUCTION!

(Under Auction Listings)

Let us know what you have to sell or auction - it’s FREE to List, and FREE to advertise. Please email [email protected]

Let us help you with your financial needs. Click Here www.payintime.com.au

Let us help you with your financial needs. Click Here www.payintime.com.au

— Robbie McKenzie

Realm Group Australia

REALM Group Australia (RGA) - originally est. 1992. The most trusted online Ag Marketing System in Australia. Built by Farmers for Farmers! Education is the KEY. True Pioneers - We were the first, and we are still growing. Proud Supporters of the Royal Flying Doctor Service (RFDS) & Ronald McDonald House Charities (RMHC)