F E A T U R E D

ARTICLE 933

🚨 Supporting Our Farming Communities: Queensland Floods & Victoria Fires 🙌

This week, our thoughts are with the farming families and rural communities impacted by the devastating floods across Queensland and the ongoing fires in Victoria. These events have placed enormous pressure on livestock owners, producers, and those caring for animals during incredibly challenging conditions.

How You Can Help 🤝

If you are able to assist in any way, the following support is urgently needed:

🌾 Hay & Fodder Donations

Donations of hay or fodder of any description, or assistance with transporting hay or livestock, are greatly appreciated.

📞 Troy Gardiner ( REALM Group Australia) – 0413 336 562

📞 Linda (Hay Runners) – 0421 972 332

🐴 Horse Relocation Assistance

If you need to relocate horses due to flood or fire risk, please visit:

🌐 www.ponyclubaustralia.com.au

They are coordinating support and safe relocation options.

🐮 Livestock Agistment Needed

If you can assist with agistment for livestock, or require help yourself, please contact:

📞 Robbie McKenzie – 0419 182 804

In times like these, the strength of the rural community truly shines. Every load of hay, spare paddock, transport run, or shared contact makes a real difference.

If you’re able to help — or need help — please reach out.

Together, we stand with Queensland and Victoria. 🇦🇺🌾🔥🌧️

We want to extend our sincere thanks and appreciation to the entire REALM team and our incredible clients who have stepped up during this difficult period. Your support through hay and fodder donations, transport assistance, livestock relocation, ground support, and countless other efforts has made a real and meaningful difference on the ground. 🙏🙏

Mormons join $1.1b American push into ‘undervalued’ Aussie farmland

American investors have delivered a massive vote of confidence in Australia’s $84-billion agriculture sector, after spending $1.1 billion buying up two huge farming portfolios in NSW and Queensland.

The acquisition of the Australian Food & Agriculture Company for $780 million includes 95,000 merino sheep.

The first deal involved the agricultural investment arm of the Utah-based Mormon Church, which has spent over $300 million to acquire around 26,000 hectares of cropping farmland in southern Queensland.

The acquisition of Worral Creek from retiring cotton growers Robert and Jennie Reardon was made by Alkira Farms, a subsidiary of the Mormon Church’s Farmland Reserve, which owns about 300,000 hectares of farmland in Nebraska, Oklahoma and Florida worth around $3 billion.

The Mormon Church – officially the Church of Jesus Christ of Latter-day Saints or LDS Church –has an investment portfolio worth US$265 billion ($391 billion).

Local agricultural asset manager Warakirri will manage Alkira Farms on behalf of the Mormon Church through a new cropping business called Solterra, led by investment director Adrian Goonan.

“Australian agriculture continues to be an attractive proposition for both domestic and global investors, providing genuine portfolio differentiation in a region that has a strong reputation globally,” Mr Goonan said.

“We are excited by the opportunities available in Australian agriculture and continue to see value from an investment in the sector that has the potential to drive strong returns into the future.”

The Worral Creek aggregation spans seven non-contiguous properties between Talwood and Mungindi in the Border Rivers region. The sale includes 65,900 megalitres of water entitlements. The property produces a diverse range of cereals and legumes, while also running a livestock breeding program and a feedlot.

“Worral Creek provides a turnkey large-scale enterprise, with exceptional irrigation infrastructure and water security, making it an ideal foundation asset for Alkira’s investment in Australian agriculture,” Mr Goonan said.

Clayton Smith and Chris Holgar from JLL negotiated the sale of Worral Creek. Ben Craw from Oxley Capital Partners was an advisor on the deal.

Bell family sells AFA for $780 million

In the larger of the two deals, NASDAQ-listed Agriculture & Natural Solutions Acquisition Corporation has acquired the Bell family’s Australian Food & Agriculture Company (AFA) in a deal valuing the Australian business at $780 million.

A new company – Agriculture & Natural Solutions Company (ANSC), which will own and operate the Australian business, is expected to list on the New York Stock Exchange or “another exchange, as agreed”.

AFA, which farms across 222,000 hectares at Hay, Deniliquin and Coonamble in the NSW Riverina region, was established in 1993 by stockbroking legends Colin, Andrew and Lewis Bell – the founders of Bell Potter.

Its 14 properties farm 95,000 merino sheep, a 19,000-strong herd of beef cattle and 35,000 hectares of dryland and irrigated row crops that produce cotton, rice, wheat, barley, canola and other crops.

The business, put up for sale following the death of Colin Bell in 2022, has delivered average annual total returns of 16 per cent over the past 10 years.

ANSC intends to further enhance returns through the development of soil carbon and other biodiversity projects, as well as by developing premium products and other initiatives.

In a presentation document published online, ANSC highlighted the attractiveness of Australia’s agriculture sector, including its “innovative farmers with a commercial mindset”, “proximity to key export markets” and its “regulated carbon market”.

“We have always believed that agriculture – backed by the right sort of capital – could deliver nature and climate solutions,” said ANSC CEO Bert Glover.

Mr Glover founded Impact Ag Partners, which, together with US asset management firm Riverstone, established ANSC last year as a NASDAQ-listed special purpose acquisition company.

The Cayman Islands-incorporated company was set up to invest in agriculture as a means to tackle climate change through carbon sequestration.

In its presentation, ANSC asserted that Australian farmland is undervalued relative to North America and Europe and “offers attractive pricing to investors”.

Pay In-Time Finance

Australian Agriculture This Week: Markets, Weather and Momentum

This week, across Australian agriculture, the theme is adaptation and forward planning.

In the eastern states, welcome summer rainfall across parts of Queensland and northern New South Wales has boosted soil moisture for late crops and pasture growth, while southern regions continue to manage patchier conditions. With climate variability now the norm, more producers are focusing on equipment, storage and logistics that give them greater control over timing and output.

On the livestock side, new methane-reduction trials have begun in New South Wales using seaweed-based feed additives. These programs are being watched closely by processors and major retailers, as lower-emission beef is expected to play a growing role in export and domestic supply chains.

At the same time, farming communities are coming together after recent bushfires, with emergency funding and recovery support being rolled out to help rebuild fencing, sheds and essential farm infrastructure.

Across cropping and livestock operations, technology investment is also accelerating. From precision planting to smarter loaders, trucks and handling systems, farms are upgrading to reduce labour pressure, cut downtime and improve efficiency during narrow seasonal windows.

In a year where timing matters just as much as yield, how these upgrades are funded is becoming a key part of the decision. Many Australian farmers are choosing asset-based finance structures that keep working capital free for fuel, seed and labour while still allowing them to modernise.

That’s where Pay In Time Finance quietly supports primary producers — structuring machinery, vehicle and equipment funding around real farm cashflow rather than rigid bank rules.

As markets, weather and technology continue to shift, the most resilient farms will be the ones prepared to move when opportunity presents itself.

WEEKLY AUCTION DATES – 2025

1.) 18th January 2026

2.) 25th January 2026

3.) 8th February 2026

4.) 15th February 2026

5.) 22nd February 2026

6.) 1st March 2026

INPUTS & COMMODITIES

Green shoots: The push to revive ASX agriculture in 2026

Australia’s beef and wheat exports are world-class, but our stock exchange is a ghost town for agriculture. Could the giants finally return this year?

Australian Agricultural Company is largely a plaything of billionaires, including Andrew Forrest and British businessman Joe Lewis.

Murray Cod’s Long Game—and the Bigger Picture for Listed Agriculture

Ross Anderson, CEO of Murray Cod Australia, is betting on the long-term future of native freshwater fish. His company breeds Murray cod in inland ponds—free from competition with ocean fishing—and supplies premium restaurants nationwide. Backed by major investors including AustralianSuper and Regal Funds Management, the business is five years into a CSIRO-led selective breeding program and plans to launch its own proprietary strain, Aquna, positioned as the “Wagyu of fish.”

“We’re playing a long game here,” said Murray Cod Australia CEO Ross Anderson. Nick Moir

Despite strong fundamentals, the company’s share price has struggled. After peaking at $4.50 in 2021, it now trades closer to $1 as Murray Cod rebuilds stock—a process that takes up to three years to reach restaurant quality. Anderson says this long production cycle makes it difficult for short-term investors to stay patient, even as global supplies of high-quality freshwater fish decline and demand rises.

The challenge facing Murray Cod reflects a broader issue across Australia’s listed agriculture sector. While agriculture is a cornerstone of the national economy, few agribusinesses feature prominently on the ASX, and returns have lagged the broader market. Earnings volatility, exposure to climate and global shocks, asset-heavy balance sheets, and frequent takeovers by private equity have kept many agri-stocks in the “too-hard basket” for investors.

That said, confidence is beginning to return. Select parts of the sector—such as olives, dairy, nuts, berries, poultry, and controlled-environment farming—are performing strongly. Advisors suggest 2026 could mark a turning point, driven by improved market stability, technology that reduces seasonality risk, and succession planning among large family-owned farms.

ProTen is among Australia’s top chicken producers and recently traded to KKR for $1.3 billion. Madison Rae

Then there are the assets that sit on banker prospect lists. As the poultry sector heats up, family-owned Baiada, which operates the Steggles and Lilydale brands, is a hot pick. It delivered $194 million profit in the 12 months to June 30 – double that of its ASX-listed rival Ingham’s – and earned the family an estimated $2.7 billion fortune.

The Crotti family’s $1 billion-plus turnover South Australian pasta giant San Remo, the Thomas family’s hefty $4 billion revenue red meat processor Thomas Foods International, and co-operative CBH Group, the GrainCorp of the West Coast with $3 billion in assets, are all names with the scale to thrive on the ASX. Of note, the Crotti family just took a 13 per cent stake in gourmet food business Maggie Beer alongside Angelo Kotses, the co-owner of the Bickford’s cordial brand.

And a couple more names to keep an eye on: Paspaley is a third-generation pearl dynasty, though the consensus is they’ll never sell. Beef cattle lot feeding operators, Mort & Co, is selling down some of its feedlot assets as part of a restructure, putting it on watch lists, and pork giant, SunPork, is still 100 per cent Australian owned.

For now, Murray Cod’s Anderson isn’t letting the naysayers hold him back. The executive is headed for the world’s biggest food show, Gulfood 2026 in Dubai, to target luxury dining in the region.

“A business like ours, which has been eating up cash, suddenly turns around the other way as the fish become available for sale,” he says. “It can turn around dramatically. The analysts can’t see it, but our backers can.”

AG MACHINERY

This Dutch company says its electric tractors will be in Australia in 2026

🌐 Learn more: www.realmgroup.com.au

EOX Tractors director and owner Hilbrand Kuiken (inset) will visit Australia next month to meet with farmers ahead of the company's planned rollout of electric tractors in 2026. Pictures supplied

The director of an international company responsible for producing one of the world's first fully-electric tractors aims to have the mid-range tractors in use on Australian farms by mid-2026.

EOX Tractors director and owner Hilbrand Kuiken said the 175- to 200-horsepower tractors would suit a range of farming applications, declaring all tractors manufactured within 20 years will be "emission-free".

The company's plan to launch its tractors in Australia next year will coincide with proposals from the likes of US manufacturer John Deere, which has announced it will launch its first EV tractor in Australia in 2026.

The Netherlands company started in 2018 as H2Trac with a goal to develop sustainable agricultural machinery.

It says many farmers are reducing their reliance on fossil fuels through the use of solar and wind, but are often unsure about the alternatives for machinery.

Mr Kuiken, a self-described entrepreneur with a background in engineering, will visit Australia this month to meet with farmers ahead of a pilot project to trial the tractors down under next year.

He will also speak at the National Renewables in Ag Conference on July 23.

"We want to reach an agreement with 10 customers this year, and, hopefully, from mid-next year or quarter three in 2026, we hope to be running in Australia," Mr Kuiken said.

The tractors are completely electric and have adjustable axles. Picture supplied

The company, EOX Tractors, was formed in 2021 after H2Trac became bankrupt.

The name stands for electric ox, referring to the strength and reliability of the animal, combined with the innovative electric drivetrain.

A unique feature of the EOX Tractors is their adjustable axles, which can be extended or retracted as needed to improve weight distribution, reduce soil compaction and allow for easier transport.

The axles are extendable from 2.25 metres to 3.20m.

The tractors are manufactured off-site, and once the machines are 95 per cent built, EOX Tractors carries out the final software testing.

"We have some really successful companies here in the Netherlands who undertake the manufacturing for us," Mr Kuiken said.

"Our focus is on the technology and development and improving the experience of the machine, not so much on the manufacturing itself, which will allow us to scale up rapidly."

Mr Kuiken is a partner of Quantillion Technologies, a company linked closely with EOX Tractors, that works with software and artificial intelligence to improve autonomous decision-making.

EOX Tractors is also behind one of the first hydrogen tractors, which runs on a fuel cell and is powered by an electric drivetrain.

The model, EOX175, is available in an autonomous battery-powered version or the hydrogen model.

The tractors have seven motors in total, including four wheel motors, one hydraulic motor, and two power-take-off motors - one each at the front and rear.

The electric version has a battery pack of 150 kilowatt hours and independent steering, allowing the tractor to maneuver easily in a tight turning radius.

"I don't expect all farmers to have hydrogen generators on site, and you can probably not just drive to a hydrogen station to fill up your machine," Mr Kuiken said.

"That's why, for Australia, we think the hydrogen tractor will be introduced when the hydrogen market becomes a bit more mature."

Mr Kuiken said Australia and Canada were two areas of focus for the electric tractors.

"We already know that 175hp to 200hp is a little too light for Australian standards, and it probably needs to be more like 300hp," he said.

"That is something we can do, and if that is a requirement for the Australian market, that is the spec we will develop.

"That is why we want to be doing these tests now and have these discussions with customers when we introduce these machines in Australia."

For Sale Listings

(List it for FREE! We promote it for FREE!)

Featured Auction Listings

RGA - REALM GROUP AUSTRALIA - MULTI-VENDOR MACHINERY AUCTION, AUSTRALIA WIDE

We’re now taking listings for our next up-and-coming auction.

Contact us today at 📞0419 182 804

AG NEWS AUSTRALIA

Farm businesses start to recover confidence

Farm businesses are showing cautious signs of recovery while continuing to grapple with climate and cost pressures, according to the biannual NSW Farmers Business Sentiment Survey.

NSW Farmers Principal Economist Samuel Miller said the new results highlighted where confidence was returning and where risks were intensifying across the state.

“We’re seeing the good, the bad, the ugly and the beautiful in this data,” Mr Miller said.

“Farmers surprised themselves with 23 per cent saying they had a year of positive growth, compared to only 2 per cent who were expecting things to get better in May.

“But dry conditions are starting to weigh on more parts of the state, with 17 per cent (up from 5 per cent in May) of all farmers worried about water allocations. It’s worse in the Murray and Riverina areas, with 48 per cent worried about water (up from 15 per cent in May).”

Despite the weather extremes, Mr Miller said overall improved conditions were giving farmers the green light to start investing again, with 40 per cent saying their capital expenditure would increase in the next 12 months, doubling from 19 per cent in May.

“We asked a special question about the Primary Producer Exemption to Land Tax, which lets us take the pulse on timely issues without impacting our longitudinal results,” he said.

“About 12 per cent of farmers indicated that they have avoided expanding or diversifying their businesses due to the risk of losing this tax exemption, which really drives home the importance of governments letting farm businesses invest in value-adding to get ahead of seasonal and geopolitical challenges.

“The good news is our advocacy team is already at work on this policy priority.”

The Future of Smart Farming

Drones and the Future of Australian Agriculture

Series Wrap-Up: From Innovation to Everyday Farming Tool

Over the course of this article series, we’ve explored how drone technology has moved from being an emerging innovation to a practical, proven, and increasingly essential tool across the Australian agricultural industry. What was once seen as “the future of farming” is now firmly part of the present.

Across crops, livestock, infrastructure, compliance, and large-scale automation, drones are delivering measurable improvements in safety, productivity, cost efficiency, and sustainability for Australian producers.

What We’ve Covered

Throughout this series, we’ve examined how drones are being used across the agricultural value chain, including:

Smart monitoring and mapping

Drones equipped with RGB, multispectral, and thermal sensors now allow producers to assess crop health, detect stress early, map paddocks, and generate data that feeds directly into precision agriculture systems, agronomist recommendations, and autonomous machinery.

Livestock and asset management

From mustering stock and checking water troughs to inspecting fences, sheds, and remote infrastructure, drones are saving countless hours while improving safety and animal welfare—particularly on large or difficult-to-access properties.

Seeding, spraying, and spreading

Agricultural spray drones have become a powerful complement to traditional machinery and manned aviation.

They offer precise, low-altitude application of fertilisers, herbicides, pesticides, seed, and granular products, reducing drift, soil compaction, chemical usage, and operator risk.

Drone-in-a-Box and automation

We looked at how fully autonomous Drone-in-a-Box systems are enabling 24/7 monitoring, remote inspections, security patrols, and rapid response—especially valuable in labour-constrained and remote regions.

Regulation and compliance

Understanding CASA Part 101 and MOS 101 is critical. We broke down what farmers and agribusinesses can legally do under the land owner excluded category, when a RePL or ReOC is required, and why regulatory compliance protects not only the individual operators, but the long-term future of the industry.

Beyond Visual Line of Sight (BVLOS)

BVLOS operations represent the next major leap forward. While they require higher levels of training, systems, and approvals, BVLOS unlocks wide-area monitoring, autonomous operations, and scalable drone deployments across large and remote agricultural landscapes.

Bringing Drones In-House or Partnering with Specialists

One of the key messages throughout this series is that there is no single “right” approach. Many producers are now choosing to bring drone capability in-house, just as they do with tractors, headers, and other farm equipment. Entry-level enterprise drones, such as the DJI

Mavic 3E, 3M, 4T, or 4M already enable a wide range of applications, including:

∙Asset and infrastructure inspections

∙Animal welfare and livestock monitoring

∙Muster assistance

∙Water and fence checks

∙Security patrols

∙Crop and paddock mapping for agronomy and automation

For others, particularly larger or multi-site operations, partnering with a specialist agricultural drone service provider can be the most efficient pathway—allowing access to advanced platforms, sensors, BVLOS approvals, and experienced crews without the upfront investment.

As with any farm technology, the right solution depends on scale, terrain, workforce, budget, and operational goals.

A Technology That’s Here to Stay

What’s become clear across all seven articles is this:

Drones are no longer a novelty, and they’re no longer optional for forward-thinking operations.

They are:

∙Reducing input costs

∙Improving decision-making through data

∙Addressing labour shortages

∙Enhancing safety

∙Supporting sustainability and environmental stewardship

As AI, automation, battery technology, and regulatory frameworks continue to evolve,

Drones will only become more capable, more autonomous, and more tightly integrated

into everyday farm operations.

Final Thoughts

Australian agriculture has always been an early adopter of technology that delivers real value. Drone technology is simply the next step in that tradition, another tool that helps producers do more with less, while protecting people, animals, and the land.

Whether you’re just beginning to explore drone technology or already integrating it into daily operations, the opportunity is clear: smarter farming, driven from the air. If this series has sparked questions or ideas about how drones could work in your operation, I encourage you to reach out, explore the options available, and take the next step with confidence.

Written by Mike Hooker

CEO / Chief Remote Pilot

Skyscan Geomatics

CASA Licensed Drone Services & Consulting

🌐 www.skyscangeomatics.com.au

Simply click www.payintime.com.au to provide your details, and we will be in touch. It all starts with one phone call.

YOUR TOWN

We Have Been to Your Town! We don’t just sit in an office; we are hands-on with our Farmers! 🙌

Please email us with a picture of yourself or a family member in front of your TOWN-SIGN to [email protected]

Field Notes with RD Creative Studio: Long-Term Insights from the RD x REALM Collaboration

Are Your Long-Term Customers Costing You Margin?

Most rural businesses are built on repeat customers. You’ll see all the same operations and numbers on the phones.

That loyalty matters because it keeps cash moving when seasons turn rough or markets stall.

But you might have noticed that it also creates habits.

Over time, the rules of those relationships stop being reviewed. They just roll forward.

What I mean by that is. . .

Prices stay where they were.

The scope grows a little.

Response times tighten.

Expectations creep.

No one decides this, but it eventually accumulates.

How margin slip without anyone touching the price

Long-term customers usually get better service. Priority, more flexibility, etc.

That feels right. Often it is. The issue shows up when effort changes but the commercial structure does not.

Extra calls during busy weeks or extra coordination because “they’re a good client”.

All reasonable in isolation, but expensive in total.

A check most operators avoid

Ask this:

If this customer came to us today for the same work, would we price and scope it the same way?

Answer it honestly. If the answer is no, just notice it.

Then notice how often the answer is no.

Where it shows up in real businesses

What gets said | What actually happens |

“We’ll just handle that” | Scope expands |

“They need it now” | Speed becomes default |

“That’s their rate” | Old pricing hardens |

“They’re easy” | Time cost disappears |

None of this is wrong. It becomes a problem when it becomes permanent.

Practical adjustments that don’t torch relationships

Separate loyalty from economics

Loyalty can earn priority, certainty, and access. It does not have to earn frozen margins.Reset selectively

One relationship per quarter. Choose the one where effort and return are clearly out of balance. Adjust the scope first. Price follows naturally when the scope is visible.Name the work again

Margin erodes fastest in work no one talks about. If it isn’t named, it can’t be managed.

When margin tightens, many operators chase new customers or more volume.

Often, the work is already there. The rules around it are just old.

If profit feels harder to hold than it should, this is worth looking at before you add more load to the system.

We spend a lot of time helping operators straighten this out without blowing up trust or reputation.

If that’s relevant, you know where to find us.

Women in Ag

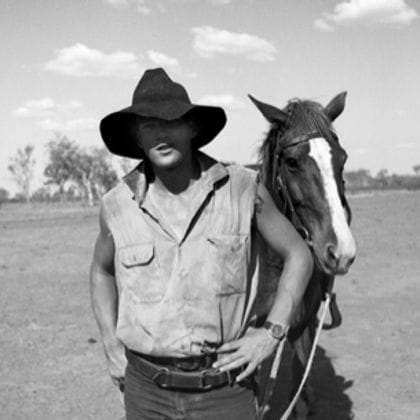

The cutting horse trainer has won significant events and has represented Australia twice in the USA.

Lynda MacCallum has always been at home in the saddle, and now it is helping her overcome a life-changing multiple sclerosis diagnosis, a chronic autoimmune disease that affects the central nervous system.

The cutting horse trainer has won significant events and has represented Australia twice in the USA.

For the past seven years, though, her horses have played an immense role in saving her life in the saddle.

This is her story.

Welcoming Simon Cheatham – RINGERS FROM THE TOP END with REALM Group Australia

Simon Cheatham- RINGERS FROM THE TOP END (RFTTE)

Simon Cheatham

Founder RFTTE - The Online Campfire | E: [email protected] or reply to this newsletter | Subscribe to this newsletter | The RFTTE Story | RFTTE MERCH

0417 277 488 | RFTTE PTY LTD | ABN 29 678 593 283

“Samantha Watkins Photography”

REALM Group Australia is proud to sponsor amateur photographer Samantha Watkins. We've seen her photography skills grow tremendously over the years, and we believe it's the perfect time for her to step into the photography world.

Click on the link to take you to her FB photography page, where you can see her beautiful photos.

It is called "Samantha Watkins Photography" https://www.facebook.com/profile.php?id=61573116870308

First sunrise for 2026.

Samantha Watkins's sample photography.

All photos are available for purchase – simply email [email protected]

And she will be happy to assist you.

Active & Upcoming AUCTION!

(Under Auction Listings)

Let us know what you have to sell or auction - it’s FREE to List, and FREE to advertise. Please email [email protected]

Let us help you with your financial needs. Click Here www.payintime.com.au

Let us help you with your financial needs. Click Here www.payintime.com.au

— Robbie McKenzie

REALM Group Australia

REALM Group Australia (RGA) - originally est. 1992. The most trusted online Ag Marketing System in Australia. Built by Farmers for Farmers! Education is the KEY. True Pioneers - We were the first, and we are still growing. Proud Supporters of the Royal Flying Doctor Service (RFDS) & Ronald McDonald House Charities (RMHC)