The headlines that actually moves markets

Tired of missing the trades that actually move markets?

Every weekday, you’ll get a 5-minute Elite Trade Club newsletter covering the top stories, market-moving headlines, and the hottest stocks — delivered before the opening bell.

Whether you’re a casual trader or a serious investor, it’s everything you need to know before making your next move.

Join 200K+ traders who read our 5-minute premarket report to see which stocks are setting up for the day, what news is breaking, and where the smart money’s moving.

By joining, you’ll receive Elite Trade Club emails and select partner insights. See Privacy Policy.

This week's roundup: A Rich Lister pivots from cars to crops, global politics tightens its grip on ag markets, large tractors kick off 2026 with momentum, and higher rates push farmers toward sharper cost control and smarter strategy. Plus, fresh listings, auction dates, and more from across Australian ag. Let's get into it →

Why Rich Lister Tony Denny Swapped Used Cars for Farming

Former car dealer and property developer Tony Denny has turned his focus to agriculture, marking a new chapter in his diverse business career. After building his fortune in Europe’s used-car market, Denny is now a key investor in the ASX-listed crop-nutrient company RLF Agtech.

A qualified horticulturalist, Denny believes boosting food production and sustainability will be vital in the coming decades. He sees “smart” crop nutrients as central to improving yields, soil health, and water retention, while also opening opportunities for farmers to earn income through carbon credits.

Aside from a small NSW farm, RLF is Denny’s main agricultural investment. The Perth-based company, which was listed in April last year, already operates across Asia, including a manufacturing base and workforce in China. Its Australian-developed technology aims to reduce reliance on bulk fertilisers while improving crop performance.

RLF services a wide range of growers, from grains and cotton to livestock producers, and is targeting large-scale Australian operations. The company has also launched a 5,000-hectare pilot program to generate Australian carbon credit units under the federal Emissions Reduction Fund.

Denny says carbon credits could benefit most broadacre farmers, strengthening both the agricultural sector and the national economy, while positioning RLF as a strong Australian R&D and export success story.

📈 MARKET PULSE - 2026 Commodity Outlook:

Politics to play a bigger role in agri markets as global tensions rise

Government intervention and trade policies are set to shape commodity prices in 2026, from wheat to cattle.

2026 Outlook: Volatility, Policy Shifts & Tighter Margins Ahead

Australia’s export-focused sectors — including grains, oilseeds, and beef — are set to face a more complex and volatile environment in 2026. Shifting trade policies, changing import rules, and strong global competition are expected to limit upside in prices, placing greater emphasis on cost control, timing, and risk management.

According to CBA’s Director of Sustainable and Agricultural Economics, Dennis Voznesenski, governments are playing a more active role in agricultural markets through trade policy, biofuel regulation, and food security strategies — thereby reducing the market’s traditional response to supply shocks such as drought.

Key themes for 2026:

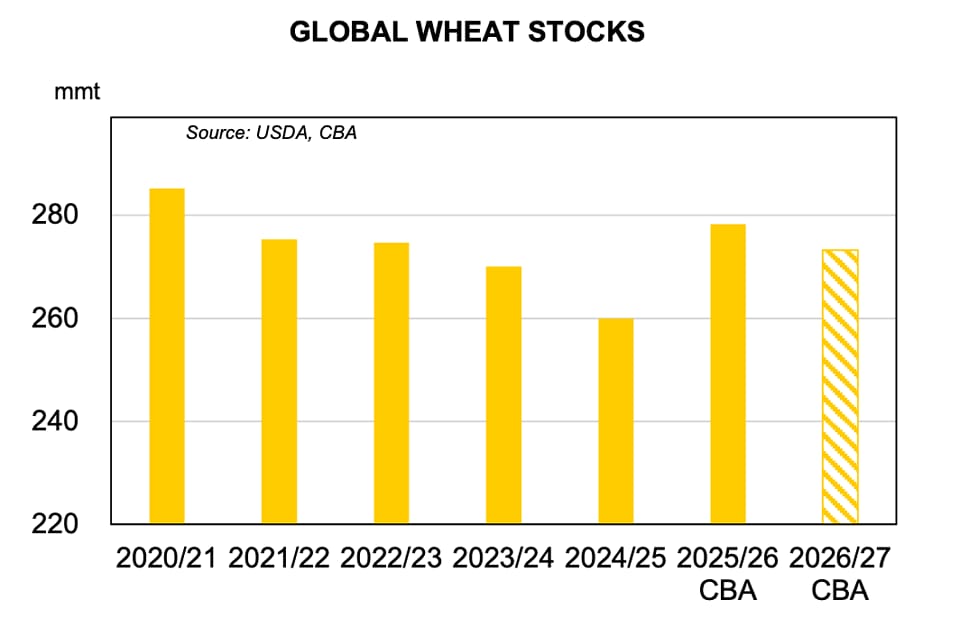

Wheat: Prices may see short-term support in late 2026 due to a weaker Australian dollar and stabilising global yields. However, increased self-sufficiency efforts from major importers such as China and Egypt could dampen long-term demand and weigh on prices.

Canola: Global stocks are expected to fall by 13% in 2026/27, supporting prices later in the year. However, early 2026 gains may be capped by carry-over stocks. Trade tensions (China–Canada tariffs), EU chemical restrictions, and US biofuel policy decisions will heavily influence price direction.

Cattle: After a strong 2025, cattle markets are forecast to be more uneven. US tariff changes and China’s beef import quotas are likely to soften demand for Australian exports later in the year. Processor cow prices may remain more supported due to ongoing US demand for hamburger beef.

Barley & Pulses: Strong production and large carry-over stocks are expected to keep these markets well supplied, limiting price growth. Indian import policy and seasonal conditions remain key variables for pulses.

The bottom line:

2026 will be less about chasing higher prices and more about managing volatility. Diversifying markets, monitoring policy changes, and maintaining cost discipline will be critical for Australian producers navigating the year ahead.

🚜 AG MACHINERY

Large tractors start 2026 in strong style:

Large tractors have started the new year by recording a significant sales lift, according to Tractor & Machinery Association figures

Large tractors in the 200hp plus range led the way in January with a sales increase of 42.2 per cent compared to the same month last year.

The next largest category – 100-200hp – also recorded an 8.4 per cent jump on the same month last year.

With January being a relatively quiet month on the sales front, a total of approximately 500 tractors were sold across the country, which was 7 per cent behind the same month in 2025.

Western Australia had a big lift of 30.2 per cent on its January 2025 sales, while Tasmania was up by 26.7 per cent, and the small market ofthe Northern Territory posted a 142.9 per cent spike.

In a complete turnaround from December, smaller tractor sales were very quiet, which drove a decline in unit sales.

As previously reported, tractor sales for 2025 were the lowest reported for more than ten years.

While the industry is not expecting a return to boom times, there is a general feeling that the bottom has already been hit and that gradual improvements can be expected.

💰 PAY IN-TIME FINANCE

Australian Agriculture Update: Higher Rates, Tighter Margins, Smarter Moves

This week, Australian farmers are adjusting to a confirmed increase in the official cash rate, a move that’s already sharpening conversations around cost control, timing and finance structures across the sector.

While the rate rise was widely anticipated, its impact is now becoming real. Variable lending costs are edging higher, overdrafts are becoming more expensive, and banks are reassessing risk across business lending. For farm businesses operating on tight seasonal margins, even small changes in interest costs can influence decisions around stocking, input purchases and capital upgrades.

At the same time, conditions on the ground remain mixed. Some regions are pushing ahead with planting and infrastructure work after recent rainfall, while others continue to manage dry conditions and rising feed and transport costs. Across both cropping and livestock operations, farmers are increasingly focused on efficiency gains — equipment that reduces downtime, transport that lowers per-unit costs, and infrastructure that improves labour productivity.

What’s changing this season is how those investments are approached. With interest rates higher, many producers are prioritising certainty and cashflow flexibility over simply chasing the lowest headline cost. Fixed or structured asset finance, staged upgrades and equipment replacement rather than repair are all coming back into focus.

This is where specialist support can make a difference. Pay In Time Finance works quietly with Australian farmers to structure machinery, vehicle and equipment funding in a way that aligns with seasonal income and operational cycles — helping reduce pressure on working capital at a time when liquidity matters most.

As rates rise and conditions remain unpredictable, the farms that plan ahead and stay financially nimble will be best placed to keep moving forward this season.

Visit Pay In Time Finance

📅 WEEKLY AUCTION DATES – 2026

1.) 15th February 2026

2.) 22nd February 2026

3.) 1st March 2026

Click here to see the list of upcoming auctions at www.realmgroup.com.au/auctions

📝 FIELD NOTES WITH RD CREATIVE STUDIO

Catalogue Season Shouldn’t Be Your Only Visibility Strategy

The sale day is usually when the money comes in. Naturally, it deserves attention, and most of the year’s preparation funnels toward those dates.

What tends to happen, though, is that the months on either side go quiet. The website sits largely unchanged, and there is little outward signal of what is happening in the program. Then, six weeks out from the sale, activity ramps up all at once. Posts increase. Emails go out. The catalogue becomes the centre of everything.

From your side of the fence, that feels focused and practical. From a new buyer’s side, it means they are being asked to evaluate your operation with very little prior exposure.

Buyers Do Not Start Thinking on Sale Week

You already know, at least instinctively, that buyers do not start thinking about your program in sale week. By the time the catalogue arrives, many of them have already formed a working view.

They may have heard your name mentioned in passing months earlier. They may have seen a mid-year performance update or noticed a client result shared online. Some will quietly look you up well before sale season just to see how you present yourself and whether the program aligns with their direction.

None of those moments triggers an immediate purchase. What they do is lower uncertainty. They create a sense of familiarity. So, when the sale day arrives, the buyer is not starting from zero. They are confirming a view that has been forming over time.

If your stud is only visible in a concentrated burst around catalogue season, all of that familiarity has to be built in a few weeks. That usually shows up as more explaining, more background conversations and more reassurance late in the process.

What a Baseline Actually Looks Like

Year-round visibility does not mean constant posting. It means steady signals.

In practical terms, this translates as:

Sharing meaningful performance or program updates a few times a year.

Documenting client results and making them visible.

Keeping your website current and clear about who your genetics suit.

Stay in touch with your email list occasionally with something worth reading.

When that baseline exists, catalogue season reinforces what buyers already understand. It does not have to introduce everything at once.

Ready to Make a Sale, Daylight?

If sale prep feels heavier each year, it may be carrying too much on its own. If you want to map a simple, steady visibility plan that supports your next catalogue instead of scrambling around it, that is work we do at RD Creative Studio.

👩🌾 WOMEN IN AG

Fleur McDonald has managed to sell over 600,000 copies of her books. She is one of Australia’s leading rural literature authors. Fleur’s work has been inspired by her life on farms. She grew up on her parents’ property in regional South Australia and now resides on her 8000-acre property in regional Western Australia.

When Fleur started working on farms in the 1990s, it was uncommon for women to identify themselves as agricultural workers. Often, Fleur was ridiculed for her choices. She also experienced sexual harassment at the hands of an overseer.

Fleur is now the Company Secretary and a board member for the industry body, Women in Agriculture. She also runs a not-for-profit organisation, Breaking the Silence, which assists women and children escaping domestic violence.

Fleur McDonald

🤠 RINGERS FROM THE TOP END (RFTTE)

Welcoming Simon Cheatham with REALM Group Australia

G’day REALM Readers,

WHAT’S YOUR FAVOURITE SMOKO?

There's something sacred about smoko on a cattle station - whether it's out on stockcamp, fencing or back at the homestead. It's not just a tea break – it can be a moment of respite in a long, dusty day... have a yarn, a chance to go over the morning's tasks or further plan for the day; and often one of the highlights of the day that gets you through to knock-off time.

We asked the RFTTE community on Facebook to share their best smoko memories, and the responses poured in like billy tea. From pufftaloons dripping with golden syrup to corned beef sandwiches under a Coolibah tree, anyone would think cattle station staff had Michelin Star chefs cooking for them - and I reckon some do!

The Legends Behind the Ovens...

The names that came up again and again in the comments: Barb Strickland earned multiple shout-outs as 'the best station cook ever'. Elizabeth Anne Kelly was praised for everything from jelly slice to beef stroganoff. Kaylene Bambrick at Tobermorey Station made marshmallow slices and 'cute little 3-layered sandwiches' that are still remembered by station staff years later.

Wendy Cox cooks up some cracking meals for the team at Tipperary Station, NT - they've become the stuff of legend. There's Wendy above showing off some of her homemade bread rolls at Tipperary... and that's one of Wendy's smoko's too.

And of course, there is Karen Smith, who has been cooking on stations including Auvergne, Newry, Tipperary, Camfield and Newcastle Waters; and currently working on a station in QLD. She is famous for her 'Pie in the Sky' for cattle station pilots (see image above), and of course her sumptuous smoko's for the ground crew too!

One for me personally was the Vanilla Slice (aka 'Snot Block') that Michael Byers (or 'Cooky'.. of course) would make at smoko for the Carlton Hill crew in the early 1990's - his smoko at the station was fit for a king... from smoked spare ribs to chocolate cake, he had it all...

On a few trips with Gus Rose taking horses to cattle stations in his road train - we had a couple of stay overs at Nerrima Station in the West Kimberley - and were always warmly greeted and looked after by Managers, Chris and Bec Morrow (and little Georgina); Gus and I would always put on a few 'kegs' after being very well fed by the Nerrima Cook, Poppy Spurling.

And I know there are plenty more... So here's cheers to all the cooks out there...Thank you!

You can add your favourite smoko and cook on the FB thread, read the BLOG: The Best Smoko You've Ever Had: Station Cooks & Their Legendary Feeds or email us at [email protected]

Check out the latest jobs at rfttejobs.com

Hooroo for now,

Simon Cheatham

Founder RFTTE - The Online Campfire

0417 277 488 | [email protected]

📷 SAMANTHA WATKINS PHOTOGRAPHY

REALM Group Australia is proud to sponsor amateur photographer Samantha Watkins. We've seen her photography skills grow tremendously over the years, and we believe it's the perfect time for her to step into the photography world.

Click on the link to take you to her FB photography page, where you can see her beautiful photos: "Samantha Watkins Photography" on Facebook.

https://www.facebook.com/profile.php?id=61573116870308

All photos are available for purchase – simply email [email protected], and she will be happy to assist you.

🚨 FEATURED LISTINGS THIS WEEK

Check out our latest machinery, livestock, and equipment listings below. New items are added weekly from farmers across Australia.

→ View all For Sale listings at www.realmgroup.com.au/listing/for-sale

→ View all Under Auctions at www.realmgroup.com.au/listing/under-auction

→ View upcoming Auctions at www.realmgroup.com.au/auctions

🏘️ YOUR TOWN

We Have Been to Your Town! We don't just sit in an office; we are hands-on with our Farmers! 🙌

Follow us on Facebook and join ROBBIE’S REALM and tell us why Robbie should come and visit YOUR TOWN!

🎙️ NEW PODCAST - TALKIN' SH*T

Ideas Paddock Podcast - Hosted by Robbie and Ramo. From Fertiliser to Finance - We Tell It Like It Is! Subscribe to YouTube and never miss an episode.

Join the IDEAS PADDOCK community and have your say!

What's your biggest challenge this season?

Cheers,

The REALM Group Australia Team