F E A T U R E D

ARTICLE 932

Minerals and microbes: A new era for farming

Queensland-based Earthlife has spent nearly three decades helping farmers and gardeners unlock healthier soils. Their natural microbial–mineral blends support sustainable practices, improve yields, and build resilience against droughts, pests, and climate extremes.

When Colin Purnell, founder and CEO of Earthlife, began experimenting with rock minerals and beneficial microbes almost 30 years ago, he identified a gap: Australian soils lacked vital minerals.

Mineral-rich rock blends help rebuild tired soils by replenishing key nutrients, such as phosphorus, potassium, and calcium. They boost water retention and root strength, helping plants thrive even in Australia’s harshest conditions.

“We identified what was necessary, and nobody would manufacture it, so we had to do it ourselves,” Colin recalls. “We proved in trials that our soil conditioner and fertiliser blends could double the water-holding capacity of soil and yields.”

Earthlife has set itself apart by focusing on both minerals and beneficial microbes, which most conventional and organic systems overlook. Supporting that journey was the late Dr Des Gleeson, a University of Queensland microbiologist, who consulted for 25 years, shaping Earthlife’s formulas.

Colin says: “Our blends aren’t patented, but they’re customisable, and they’ve stood the test of time.”

Still based in Toowoomba, Queensland, Earthlife manufactures contaminant-free soil conditioners and fertilisers for growers across Australia.

Supporting Farmers Towards Sustainability

While gardeners remain a loyal base, Colin is keen to re-engage farmers.

“We help farmers transition to more sustainable, economical practices, including carbon farming,” he says. “It’s about building healthier soil, improving yields, and cutting costs without high-nitrogen fertilisers.”

For backyard gardeners, Earthlife is applied whenever new plants go in. On farms, a single annual application is often enough to achieve lasting improvements.

A Queensland avocado grower, Robert Beer of Childers, saw soil carbon levels nearly triple within three years of using Earthlife products, adding the equivalent of 30,000 litres of water per hectare.

In Armidale, NSW, cattle producer Josh Billing reported healthier pastures and weight gains rising from 0.8 to 1.5 kilograms per day after adopting Earthlife.

Other Queensland testimonials echo the results. Ernie Martin of Upper Flagstone Creek noted his trees “outgrowing the toxicity problem” and producing uniform fruit. Meanwhile, Nick Adamson of Leyburn turned his “worst producing cotton block into the highest yielding block” using Earthlife’s soil system.

Colin explains: “Our approach strengthens root systems and plant cell structure so crops handle climate extremes and disease—while reducing reliance on synthetic inputs.”

Looking Ahead

As Earthlife approaches its 30th anniversary in 2026, the business remains true to its founding vision.

“We’re not chasing fads,” Colin insists. “Once you fix the base, everything else follows: productivity and resilience.”

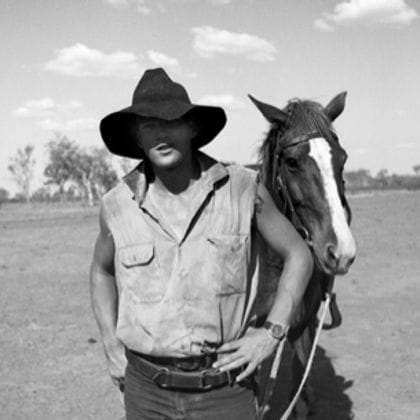

Colin Purnell

Company Info Pop Up:

Key Benefits of Earthlife’s 12+ Customisable Products

· Doubles soil water-holding capacity and improves soil structure

· Boosts organic carbon levels, supporting carbon farming and resilience

· Strengthens roots and cell walls for climate extremes

· Reduces need for high-nitrogen fertilisers, saving water and costs

· Safe, natural, and contaminant-free; several products Certified Allowed Inputs

Pay In-Time Finance

What’s Shaping Farm Finance Right Now

We’re moving further into the year, and the signals coming out this week are becoming clearer for farm businesses planning ahead.

On the finance side, lending conditions remain steady, but there’s a noticeable shift in tone from lenders. Credit teams are becoming more selective, particularly around cash-flow forecasts and exposure to weather-affected regions. While rates haven’t moved, approvals are taking a little longer, and documentation standards are tightening. That makes preparation and timing more important than price alone.

Out in the regions, seasonal variability is front of mind. Some areas have benefited from recent rain, while others are still managing dry profiles and cautious input spend. This has flowed through to decision-making: more farmers are delaying large commitments unless funding is clearly structured around seasonal income, rather than fixed monthly pressure.

Another development this week has been increased activity around rural contracting and services. Earthworks, fencing, and harvest contractors are reporting strong forward bookings, which suggests many producers are planning infrastructure and productivity upgrades despite uncertainty. The common thread is that these investments are being made carefully, with a focus on preserving liquidity.

What this means in practical terms is that 2026 is shaping up as a year where how you finance things will matter as much as what you finance. Access to capital is still there, but it needs to be set up properly and early.

At Pay In Time Finance, we’re working with farmers this week to stay ahead of these shifts — lining up funding before lender appetite changes further, structuring repayments to suit real farm cash flow, and ensuring there’s enough flexibility built in to handle seasonal swings without stress.

If you’re reviewing plans for upgrades, contracting work, or simply want certainty around funding for the months ahead, now is a good time to have that conversation and get things organised while options are still wide open.

WEEKLY AUCTION DATES – 2025

1.) 11th January 2026

2.) 18th January 2026

3.) 25th January 2026

4.) 8th February 2026

5.) 15th February 2026

6.) 22nd February 2026

7.) 1st March 2026

INPUTS & COMMODITIES

Farmers looking to a more stable 2026 as spending confidence grows: rural survey

Home / Farmers looking to a more stable 2026 as spending confidence grows: rural survey

January, 2026

Farmers’ confidence is expected to grow next year, along with greater stability. Photo: ANDREW KACIMAIWAI

Farmers are ending the year expecting a mostly stable year ahead and a desire to spend more on their businesses.

This was the main finding of the fourth quarterly Rabobank Rural Confidence Survey that was just released (December 17).

Despite ongoing concerns about rising costs and unpredictable weather, three in four farmers expect operating conditions to improve or stabilise over the next year, it says.

Rabobank group executive for Country Banking Australia, Marcel van Doremaele, says farmers are ending the year on a steady footing.

“After a period of volatility – especially from a seasonal perspective – farmers are shifting their expectations towards greater stability in 2026, with nearly half anticipating it will be ‘business as usual’ in the year ahead,” he says.

“Input costs, drought concerns and softer commodity prices continue to weigh on outlook, but these challenges haven’t shaken farmers’ broader confidence.”

Positive signs in key commodity markets are fuelling this confidence, aided by better seasonal conditions and what may be another bumper harvest, he adds.

FARMERS ON SPENDING

The survey found 33% of respondents intend to spend more on their farms, while 55% plan to spend the same.

Van Doremaele says that while rising costs of everything from fuel to fertiliser to labour and insurance mean farmers remain cautious as the year ends, their desire to invest in their farms is the highest since June 2022.

“Farmers across the country are concerned about the impact that high input costs are having on their farming business, with this topping the list of concerns in all states in this survey,” he says.

“Farmers are facing sustained inflation across almost every major input cost… It’s no longer just fuel and fertiliser; everything from machinery repairs to labour and insurance is tightening margins, and when markets soften, such as wheat and cotton, those rising costs become even harder to absorb.”

The survey completed last month shows that national rural confidence is sitting at 6%, declining from 14 per cent in the previous quarter.

Nearly half of the farmers surveyed (48%) expect conditions in the agricultural economy to remain stable in the year ahead, increasing from 41% in quarter three.

A further 27% are anticipating an improved outlook for agriculture in 2026 (albeit down from 35% with that view in the previous survey).

The proportion expecting conditions to deteriorate is stable at 22%.

Nationally, grain growers were the only commodity group where sentiment ticked up this quarter, although red meat producers were the most bullish in their outlook.

High cost remains the top concern for farmers in the survey (for 37% of respondents), while drought remains a worry for 33%.

About 24% of respondents were worried about the impact of falling commodity prices on their businesses, particularly grain, cotton and sugar cane growers, while 31% cited worries about government policy, down from last quarter’s 39%.

Concern about the implications of overseas economic conditions also fell to 19% from 24% previously.

On the other side of the ledger, farmers overall were still feeling positive about commodity prices, which remained the leading source of optimism, with 50% tipping that they will drive positive conditions.

Seasonal conditions were considered a positive factor for 46% of farmers, down from 49% last quarter.

STATE OF PLAY

Victoria again registered a 3% rise in farm confidence to 24% (the highest since 2021), fuelled by expectations of a strong season and stable commodity prices.

Tasmanian farmers remain the most confident farmers in the country, despite a dip of 3% to 31%; only 5% of farmers expect conditions to worsen in 2026.

New South Wales farming confidence fell the most, from 15% to -3%; producers in the state’s north fared better seasonally compared to the southern regions, which had a tougher season.

In Queensland, rural confidence fell from 10% to -1% due to dry seasonal conditions heading into summer, while some commodities like sugar are facing pricing headwinds.

South Australian farmers’ spirits were less optimistic as well, from 8% to 6%, weighed down by rising costs but may be boosted by late spring rainfall; this year’s winter crop is forecast to be 67% higher than last year’s drought-impacted harvest.

In Western Australia, rural confidence fell slightly (from 0% to -7%), although the state is in the midst of a very strong harvest.

Marcel van Doremaele. Photo: supplied

“Farmers across the country are concerned about the impact that high input costs are having on their farming business, with this topping the list of concerns in all states this survey.” Marcel van Doremaele

SPENDING PLANS

Australian farmers overall reported an increased appetite for investment this quarter, indicating their long-term confidence in the performance of the sector, says van Doremaele.

The survey found a third of Australian farmers plan to increase investment in their farm businesses in the coming year (33%, up from 29%), while only 10% expect to reduce investment levels (previously 9%).

Just over half (55%) plan to maintain spending at current levels.

A total of 63% of respondents intend to invest in on-farm infrastructure, including fences, yards and silos, while more than a third of Australian farmers will spend on new technologies (39%) and new plant and machinery (35%).

Plans to increase livestock numbers remain firm for 29% of farmers, and investment in irrigation or water infrastructure held steady, planned by 23%.

Appetite for purchasing farmland remained stable, with 16% of farmers across the nation looking to expand their holdings.

This was led by South Australia, where there was a significant increase in expansionary plans this quarter on the back of improved seasonal conditions from 12% to 23%.

This increase was despite some reservations about interest rates, with a small but growing number of SA farmers citing rates as a cause for concern.

“While earlier expectations pointed toward interest rate cuts, the latest indicators suggest a more cautious approach from the RBA to combat inflation, as we’ve recently seen with the December announcement to hold the OCR [official cash rate] steady,” says van Doremaele.

Income expectations for the coming year remain largely positive, with 41% of Australian farmers expecting their gross farm incomes to rise over the next 12 months (unchanged from last quarter) and 38% expecting them to remain steady.

However, the number expecting incomes to decline went up to 20% (previously 16%).

A comprehensive monitor of outlook and sentiment in Australian rural industries, the Rabobank Rural Confidence Survey questions an average of 700 primary producers across a wide range of commodities and geographical areas throughout Australia quarterly.

Cheers AK

AG MACHINERY

Autonomous R4 Robot Series Designed to Answer Specialty Crop Farming Challenges

🌐 Learn more: www.realmgroup.com.au

Two versions released – one for vineyard, one for orchard applications

R4 Electric Power is electrically powered by a 40kWh battery pack

R4 Hybrid Power is fully-hybrid with an HVO-compatible diesel engine and a 44kW diesel / electric generator pack

New Holland, a recognised leader in both speciality crops and alternative energy solutions, is previewing an advanced concept at Agritechnica. The new R4 robot series is designed to help vineyard, orchard and specialty crop growers overcome sector challenges, including labour shortages and demands for more environmentally-friendly food production.

“High-value crops have huge market potential, but growers face production challenges including skilled labour shortages for highly repetitive work during seasonal peaks,” says Thierry Le Briquer, Grape, Olive & Coffee Global Manager at New Holland. “R4 robots have been developed to automate such jobs, boosting both efficiency and sustainability with a zero-emission solution.”

Engineers from the CNH R&D Centre in Modena, Italy, and the New Holland Centre of Excellence for Speciality Harvesting in Coëx, France, together with colleagues from around the world, set out to refocus skilled human input where it matters: in value-added tasks. The resulting R4 robots execute repetitive, lower-value tasks where accurate and safe work does not depend on human presence – jobs such as inter-row mowing or tillage. The two autonomous robots also address the most time-consuming tasks in vineyards and orchards – spraying, for example. Managed via an app, R4 machines are controlled via a combination of GPS, LIDAR and vision cameras.

“R4 is an all-new concept — there is no cab,” continues Le Briquer. “It has been designed fresh from the ground up, yet it is built entirely on our in-house foundation and using our expertise in electronics, powertrains, precision tech, and more. It’s the newest member of our product family, joining our lineup alongside tractors, grape harvesters, and other machines."

“What makes it even more powerful is that it leverages the same autonomous tech stack and components we’ve developed for our cash crop and row crop platforms, showing the scalability and flexibility of our solutions. It fits right into our full product offering, sharing systems such as FieldOps and the same autonomy platform used across both cash crop and specialty machines. This makes it highly flexible, easy to upgrade, and well-supported for the future.”

Two R4 Versions

New Holland has developed two versions of the R4 autonomous machine concept, each tailored to meet the specific needs of different specialist crop sectors. Both feature suspended rubber-track drive units to maximise traction and minimise compaction, and incorporate an intelligent, continuously variable electric drivetrain. They can power implements electrically without hydraulic oil, reducing maintenance requirements, components, weight, emissions, cost and compaction. Both machines are compatible with existing implements.

Targeted primarily at high-end narrow vineyards, R4 Electric Power is electrically powered via a 40kWh battery pack.

With a 1.38m maximum height and overall width of just 0.7m, the R4 Electric Power can work in 1.0-1.5m crop spacings and weighs just one tonne. A custom-designed, ultracompact hitch has a 500kg lift capacity, and the machine can also power electrically driven implements.

The bigger full-hybrid model, R4 Hybrid Power, is designed for orchards and fruit producers and offers more power and extended autonomy, with a power-to-weight ratio double that of a conventional speciality tractor with similar output. Weighing 1,400kg and measuring 1.2m wide, the machine is optimised for row spacings of 1.5m and above. Its double-pass capability ensures complete coverage, allowing it to operate efficiently in large orchards without misses.

Power is provided by a 59hp/44kW diesel engine, which can run on vegetable oil-based fuels to cut emissions. This drives an electric generator pack for transmission and implements power. When suitable, R4 Hybrid Power can run in fully-electric mode, with the two 4kWh batteries powering the machine for zero-emission and quiet operation. The electrically-powered Cat I/II hitch is maintenance-free. A mechanical 540rpm PTO with intelligent progressive clutching works with standard implements, and a 48V/12kW e-PTO socket can power future electrically-driven machines.

Implement Functions

Intelligent electrical implement management functions were conceived to ensure operator safety and further minimise the environmental impact of both R4 machines.

For example, intelligent spraying technology can automate flow rate control and both headland management and canopy gap on/off switching. It also automates spraying by canopy height. Additionally, work is continuing to develop a system to enable spot spraying according to disease detection.

“Our goal was to create fully autonomous machines requiring only remote supervision,” says Le Briquer. “R4 is a sustainable, intelligent, and adaptable robotic solution that offers exceptional value and a lower total cost of ownership compared to current alternatives. Built with proven components from within our ecosystem, R4 Electric and Hybrid Power gives farmers a reliable, future-ready advantage as they look to boost productivity and meet today’s labour and environmental challenges.”

For Sale Listings

(List it for FREE! We promote it for FREE!)

Featured Auction Listings

RGA - REALM GROUP AUSTRALIA - MULTI-VENDOR MACHINERY AUCTION, AUSTRALIA WIDE

We’re now taking listings for our next up-and-coming auction.

Contact us today at 📞0419 182 804

AG NEWS AUSTRALIA

Electric Tractors are Coming to Australia in 3 years!

Revolutionising Agriculture: John Deere's Autonomous Electric Tractors Launching in Australia in 2026

John Deere has announced that autonomous battery-powered electric tractors will be tested in Australian conditions and set to launch here in 2026. But what does ‘electrification’ mean for ag machines?

We plan to extensively test the electric tractors in Australia to ensure they can perform in and withstand our unique challenges and conditions. This will include testing and validating electrical infrastructure requirements, connectivity and machine performance. We will also be testing the machine in various other regions across the world.

Steph Gersekowski, John Deere Australia and New Zealand Production System Manager

The journey towards battery-powered electric agricultural machinery is a significant step-change in crop production. John Deere’s Australia and New Zealand Production System Manager, Steph Gersekowski, says there are plenty of benefits in this new technology. Here is our interview with Steph.

H&P: Can you tell us about the move to electrification? How long has John Deere been working on this?

Steph: We’re seeing customer appetite for low and no-carbon alternatives to diesel technology continue to grow, particularly as our larger and corporate customers set their own sustainability targets. As a result, Deere has prioritised our investment and development in battery electric technology to ensure we can meet our customer requirements.

The strategy also aligns closely with our own company sustainability targets. We’ve been developing this technology for many years, and a testament to this is our highly successful TE gators, which have been available to Australian customers for well over 15 years. In addition, we’re working with innovators and industry to accelerate our ability to deliver fully battery-electric products to the market. A great example is our majority ownership of Kreisel [battery technology company] and the launch of this machine globally by 2026. Explore Kreisel.

A great example is our majority ownership of Kreisel, a battery technology company.

H&P: How would you describe this shift, not only for John Deere but for the industry as a whole?

Steph: As the demand for diesel alternatives grows, it will create a monumental shift not only for manufacturers but for the entire agriculture sector. When we announced this project at Hort Connections last year, I compared our plans for an autonomous battery electric tractor to that of our transition in 1918 from horse-drawn ploughs to our first tractors, the John Deere Tractor and Waterloo Boy.

H&P: What are the benefits of electrification to producers and to the environment?

Steph: Electrification will support lower CO2e emissions and lower total cost of ownership for customers over the lifecycle of their machine. Battery electric technology reduces machine complexity while improving uptime – which means less maintenance costs (parts, servicing, etc.) and greater productivity. The simplicity of the machine also supports easier and more intuitive operation, which is particularly valuable when sourcing skilled labour is a challenge. There are also benefits in terms of noise reduction, which will support customers operating machinery around livestock.

H&P: Why is the tractor being aimed at high-value crop production/horticulture?

We believe horticulture is ready for a technological leap, plus they are already setting their own sustainability targets. Additionally, the machine requirements (horsepower, job applications) and farm infrastructure within horticulture will support the transition to battery electric and provide the greatest initial opportunity to demonstrate productivity improvements.

H&P: In addition to the tractor, are there any other battery electric tech products John Deere is planning to bring to the market?

Our strategy is to deliver a comprehensive solution for customers, not just a battery electric tractor. Our plans also include the batteries and chargers.

H&P: How does electrification tie in with the drive towards autonomous tractors? What are the benefits of combining the two?

Electrification will help support autonomy capabilities as all the control systems can be integrated electronically – a far simpler process compared to diesel technology. This will provide the ability to achieve rapid uptake and scaling of autonomy for horticulture customers.

H&P: Are there any old ideas or myths about battery technology that you’d like to see addressed?

Access to battery electric technology used to seem like a faraway, idealistic concept; however, our goal is to demonstrate that it can be a feasible option for producers who want a viable alternative to diesel technology. There’s sometimes a misconception that performance and uptime may be compromised by transitioning to new technology like this, but we plan on busting this myth.

We also want to reassure our customers that battery electric vehicles are not going to completely replace our diesel engines. Rather, it will expand our portfolio to support a greater range of customer needs.

The Future of Smart Farming

AgTech Down Under: How Drones Are Transforming Australian Farming

January 2026 Edition

In 2025, we discussed the various use cases of drones in agriculture. You don’t have to go through this transition alone; there are drone businesses around Australia, like Skyscan Geomatics, that have teams that specialise in the agricultural sector that can assist with this pivotal transition. From testing to see if the technology is suitable for your operation to full-scale deployments within large multi-site operations. Drone-powered precision farming is the next evolution in the Australian agriculture industry. From aerial spraying to crop monitoring and data-driven decision-making, Australian businesses are deploying drones to boost efficiency, sustainability and profitability across broadacre fields, orchards, and pastoral enterprises. Here’s a look at the key trends shaping the agricultural drone industry in 2026.

🌱 What Services Are Australian Drone Businesses Offering?

Across the sector, agricultural drone businesses are delivering a mix of the following services:

• Aerial Spraying & Spreading: Rapid, precise application of fertilisers, herbicides and crop protectants with reduced drift and soil compaction.

• Crop & Pasture Mapping: High-resolution imaging and multispectral data for plant health, stress detection, nutrient management and irrigation planning.

• Variable-Rate Applications: Targeting inputs only where needed, lowering chemical use and environmental impact.

• Seeding & Soil Management: Efficient broadcast of seeds and soil amendments in areas hard to reach with conventional machinery.

• Data-Driven Decision Support: Using drone imagery and analytics to guide crop rotation, pest control and harvest timing.

• Site Security and Inspections: Using domes to conduct manual or automated patrols of sites and infrastructure to ensure safety and security. USING a drone to inspect site infrastructure to identify issues with assets before they become an issue to operations.

📊 Industry Trends & Future Outlook

• Precision Agriculture Adoption Continues to Grow: Australia’s vast farms and diverse crop systems are ideally suited to drone-based solutions that reduce costs and amplify insights.

• Local Innovation & R&D: Australian research collaborations and start-ups are pushing boundaries — including projects aiming at larger-payload, long-range electric UAVs and autonomous livestock management drones.

• Tech + Data Integration: AI and machine learning are increasingly used for weed detection, biomass estimation and predictive analytics, enhancing both sustainability and productivity.

• Regulatory & Skills Evolution: Commercial drone operations require CASA licences and certifications, creating opportunities for trained operators and supporting a professional services market.

✨ Conclusion

From small-scale specialist operators to national contracting fleets and DJI retailers, the agricultural drone ecosystem in Australia is dynamic and expanding. These technologies are redefining farm practices, making high-tech tools accessible to growers, cutting input waste, and stimulating growth in precision farming services across the country. Whether you’re a grower, service provider or ag-tech enthusiast, this sector offers a high altitude view of agriculture’s future with drones playing a central role in feeding and managing the land sustainably.

As mentioned in my last article, throughout this series, if you have any questions or would like me to go into more detail on a drone use case or technology, please check out our website or contact me directly. My contact details are on our website www.skyscangeomatics.com.au

Written by Mike Hooker.

CEO / Chief Remote Pilot.

Simply click www.payintime.com.au to provide your details, and we will be in touch. It all starts with one phone call.

YOUR TOWN

We Have Been to Your Town! We don’t just sit in an office; we are hands-on with our Farmers! 🙌

Please email us with a picture of yourself or a family member in front of your TOWN-SIGN to [email protected]

Field Notes with RD Creative Studio: Long-Term Insights from the RD x REALM Collaboration

Why Your Best Customers Don’t Refer You Anymore

Referrals are still the bread and butter of rural business. Most work still starts with someone saying, “Give them a call.”

So when referrals slow, the easy explanation is timing. After all, it’s January. People are busy. Everyone’s resetting.

Sometimes that’s true. Other times, something simpler has happened.

And no, it’s not that your customers stopped liking you. They may still use you regularly. You’ve just made it harder for them to vouch for you without realising it.

Let’s unpack where that usually happens.

Loyalty doesn’t always turn into advocacy

Referring you isn’t automatic. It asks the customer to do three things quickly:

Decide when you’re relevant

Explain what you do

Feel confident they won’t look foolish for suggesting you

As businesses grow, those three things get harder.

You add services.

You take on exceptions.

You customise for long-term clients.

You say yes where you used to say no.

None of this is wrong. But over time, the story becomes harder to retell.

So when someone asks, “Who should I call?”, the answer hesitates.

“They’re good… it just depends.”

A test most people never run

Do this once this week. Imagine a solid customer is asked this without warning:

“What do they actually do?”

Assuming they get 15 seconds to answer, write down the first sentence you think they would use.

If it sounds like:

“They do a bit of everything”

“They’ve been around for years”

“They’re good people”

That’s trust. Not advocacy.

To distinguish:

Trust keeps customers. Advocacy brings new ones.

Three practical fixes that don’t create homework

1. Define one referral moment per customer type

Not a list of services. A situation.

“We’re the right call when ___ happens.”

If you serve multiple groups, each needs its own moment. If it isn’t clear to you, it won’t be clear to them.

2. Lead with what you are known for, not what you can do

Capability lists don’t help referrals. Outcomes do.

If a service does not help someone decide whether to call you, stop leading with it. Keep it in the background where it belongs.

3. Give customers a sentence they can reuse

People do not like inventing language on your behalf.

“They help ___ avoid ___.”

If that sentence exists, referrals feel safe. If it doesn’t, people stay polite and silent.

The part is worth sitting with

If referrals have dipped, it is rarely personal. It is usually structural.

Recommending you has started to require thought. Thought is friction. Friction kills referrals.

This is a signalling issue, not a relationship one.

And it is fixable.

If you are unsure what your customers would actually say about you, that uncertainty is useful information.

We help rural and agribusiness operators tighten that story once growth has made it messy.

Women in Ag

The majority of farm wealth is managed by women.

The importance of having everyone involved in the farm and management. Over 35% of farms are now managed or co-managed by women, and they statistically live 5-6 years longer than males. The majority of farm wealth is managed by women.

More information at Boa Safra Ag LLC.

Full episode at https://lnkd.in/gW5iBsBM

Welcoming Simon Cheatham – RINGERS FROM THE TOP END with REALM Group Australia

Simon Cheatham- RINGERS FROM THE TOP END (RFTTE)

Simon Cheatham

Founder RFTTE - The Online Campfire | E: [email protected] or reply to this newsletter | Subscribe to this newsletter | The RFTTE Story | RFTTE MERCH

0417 277 488 | RFTTE PTY LTD | ABN 29 678 593 283

“Samantha Watkins Photography”

REALM Group Australia is proud to sponsor amateur photographer Samantha Watkins. We've seen her photography skills grow tremendously over the years, and we believe it's the perfect time for her to step into the photography world.

Click on the link to take you to her FB photography page, where you can see her beautiful photos.

It is called "Samantha Watkins Photography" https://www.facebook.com/profile.php?id=61573116870308

First sunrise for 2026.

Samantha Watkins's sample photography.

All photos are available for purchase – simply email [email protected]

And she will be happy to assist you.

Active & Upcoming AUCTION!

(Under Auction Listings)

Let us know what you have to sell or auction - it’s FREE to List, and FREE to advertise. Please email [email protected]

Let us help you with your financial needs. Click Here www.payintime.com.au

Let us help you with your financial needs. Click Here www.payintime.com.au

— Robbie McKenzie

REALM Group Australia

REALM Group Australia (RGA) - originally est. 1992. The most trusted online Ag Marketing System in Australia. Built by Farmers for Farmers! Education is the KEY. True Pioneers - We were the first, and we are still growing. Proud Supporters of the Royal Flying Doctor Service (RFDS) & Ronald McDonald House Charities (RMHC)