F E A T U R E D

ARTICLE 909

Conservationists say they have been shut out of plans for Queensland state forests as the government consults with industry

Strict sustainability rules apply in Queensland state forests. (ABC News: Will Murray)

In short:

The LNP made a pre-election promise to establish a timber plan in its first year in government.

The government has since established a ministerial roundtable made up of industry voices, which excludes conservationists and other groups.

What's next?

The Queensland Future Timber plan will be released before October, outlining the next 25 years of the state's timber industry.

Conservationists say they have been shut out of planning for the future of Queensland state forests, as the government develops a 25-year plan for the timber industry. The LNP made a pre-election pledge to deliver a Queensland Future Timber Plan (QFTP) in its first year in government, which will be up in October.

Premier David Crisafulli has promised to give the forestry industry consistency to build one million homes by 2044. The Timber Supply Chain Ministerial Roundtable, made up of forestry, housing, and agricultural industry bodies, met for the first time in May.

In contrast, the previous government's advisory panel had scientists, First Nations leaders, and conservationists, in addition to industry representatives.

Land cleared for logging in the Bauple State Forest in the Fraser Coast region. (ABC News: Will Murray)

Andrew Picone from Pew Charitable Trusts, who was a member of that group, said conservationists were miffed by their exclusion.

"At the moment the decision is being made between the timber industry and Queensland government, and we don't feel that is the right approach, it's certainly not transparent," he said. "We're talking about three million hectares of public native forests."

Andrew Picone says the government's industry panel has many conservationists worried. (Supplied)

Minister for Primary Industries Tony Perrett said QFTP was "future-proofing the forest sector after the former Labor government plan was never delivered".

“This industry roundtable is contributing to a draft of the Queensland Future Timber Plan, which will be released for wide-ranging and open public consultation," he said.

History of collaboration

Mr Picone said Queensland had a history of collaboration between conservationists and the forestry industry.

The South-East Queensland Forestry Agreement, made in 1999 by the Beatty Labor government, is an example of that collaboration, with all sides agreeing native hardwood forestry would end in most state forests south of Gladstone by the end of 2024.

That agreement was altered in 2019 by Annastacia Palaszczuk to only cease native hardwood logging in forests south of Noosa in 2024, and to extend logging north to Gladstone until at least 2026.

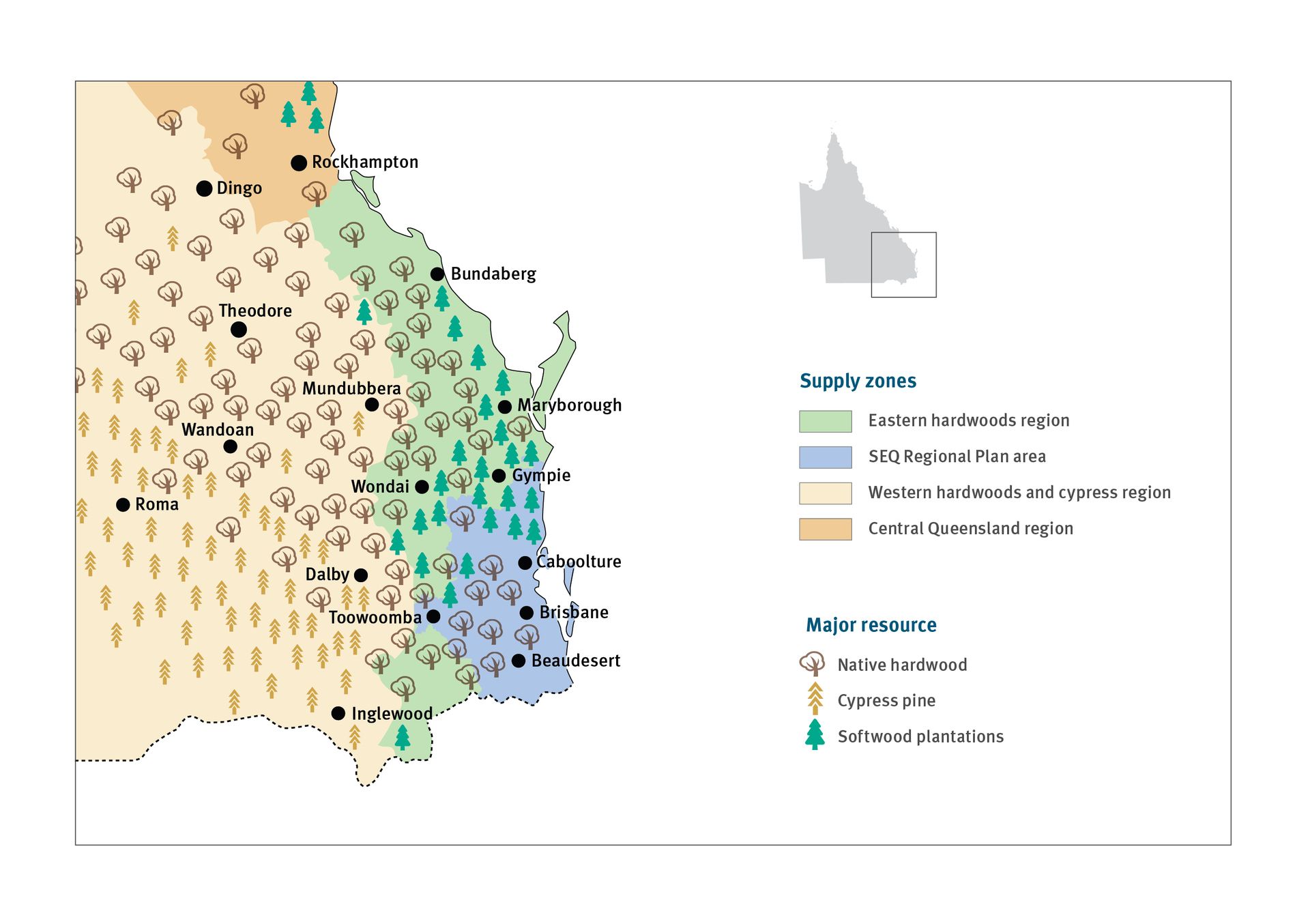

Logging was banned in the SEQ regional plan area in 2024, but continued in the eastern and western hardwoods regions. (Supplied: Queensland Department of Agriculture and Fisheries)

Mr Picone said he worried the new government's process left the door open to further water down the 1999 agreement.

"The Queensland government isn't ruling out opening up areas we thought they were finished with — opening them back up to logging. So we're quite concerned about that," he said.

'Changing positions and backflips'

The chief executive of Queensland's oldest conservation group, National Parks Association Queensland, Chris Thomas, said "changing positions and backflips" by consecutive state governments had "created animosity" between conservationists and the logging industry.

"I think the relationship is getting harder and more adversarial the longer this goes on," he said.

Tony Perrett says the plan will be opened up for public consultation soon. (Supplied: Tony Perrett)

The state's peak body for forestry and logging, Timber Queensland, which is part of the government's roundtable, declined to comment, instead pointing to a press release from May. The release said the QFTP would "remove barriers and pave the way for sustained growth" of the industry.

"We look forward to working on a bold plan that delivers policy certainty to increase sustainable production while at the same time safeguarding the environment," chief executive Mick Stephens said at the time.

"The assumption that harvesting timber from native forests is necessarily harmful to biodiversity is not correct."

Pay In-Time Finance

Climate, Cattle and Competition: August Kicks Off With Pressure and Promise for Aussie Farmers

As August rolls in, Australian farmers are facing a mixed start to the season. Widespread rain through key cropping zones has boosted winter crop confidence—but for livestock producers, a growing storm is brewing beyond the farm gate.

The recent decision by Australian authorities to allow increased imports of U.S. beef has triggered concern across the cattle sector. With American producers facing oversupply and lower domestic demand, the shift will see more U.S. beef hitting Australian shelves in the coming months—creating price competition at a time when many local graziers are just finding stability after years of volatility.

For cattle farmers, the impact isn’t just market-based. Lower demand for domestic products could place pressure on saleyard prices and margins, especially for smaller operators. Combined with elevated feed costs and unpredictable rainfall patterns, this has sparked a renewed focus on operational resilience—both on the ground and in the books.

Meanwhile, the broader ag sector is navigating a season that’s hard to pin down. Winter rainfall has replenished some soil moisture levels, particularly across parts of New South Wales, southern Queensland, and Victoria. But forecasts suggest a drier spring may follow—meaning farmers are walking a fine line between cautious optimism and measured planning.

That’s translating into a different tone in the finance space. Instead of reacting to rate chatter, producers are digging into their numbers and asking: Is my funding strategy still fit for purpose? Many are reviewing how their finance lines are structured—especially around working capital, machinery planning, and contingency buffers.

At Pay In Time Finance, this trend is showing up across the board. More graziers and growers are approaching us not just to ‘get finance’—but to work out the best timing and structure to match their season, margin pressures, and livestock or crop cycles. With the cattle sector facing added pressure from overseas imports, the need for flexibility—not just funding—is clearer than ever.

In some regions, there’s also renewed interest in diversifying farm income. From off-paddock logistics and freight, to small-scale processing or agri-tourism, more rural operators are exploring ways to strengthen their income streams—and the right finance can play a big role in getting those ideas off the ground.

WEEKLY AUCTION DATES – 2025

1.) 08th August 2025 2.) 22nd August 2025 3.) 12th September 2025

Ag Machinery

Tyres, Wheels, or Rubber Tracks: get advice on what is best for your operation

I get asked this question a lot, which is better - Robbie

Let Big Tyre help you choose what is best from 50 different brands of tyres and tracks from all the big names, with over 4,000 unique options

Biosecurity - Why Biosecurity Isn’t Just for Big Farms. Big Tyre can offer the benefit of 25 years of repairing and rebuilding over 1,300 rubber tracks with a collective saving of over $10 million compared to the cost of buying new

Since the first successful pneumatic tyre was invented in 1888 by John Dunlop, billions of dollars of research and development have been poured into the industry to provide us with the tyres, tracks, and wheels we use today, but not all products are created equal.

Cut through all the clutter of what is a good tyre or track, including all about the science behind them, by talking to the farm specialists, Big Tyre.

When you contact the team at Big Tyre, you can be confident that they’re working with you to get you the best value for money for your application.

To select the right tyre wheel or track for your farm operation, contact Big Tyre for the benefit of over 25 years of advice

Unlike many dealers who have a limited range of brands, Big Tyre sells about 50 different brands of tyres, including all the big names you have come to know and trust, adding up to over 4,000 unique tyre options.

You can find every tyre, wheel or track listed on their webstore on this

Not only do Big Tyre sell new tyres, but they have also repaired tens of thousands of tyres over the last 70 years in their factory, so they know what they are talking about when it comes to product quality and what works best in different applications.

In many cases, Big Tyre can help save you money by repairing or even rebuilding your tyres in their Toowoomba, QLD factory and dispatching them back to the farm once completed.

Big Tyre stocks over 50 different brands of tyres from all the big names you have come to know and trust, adding up to over 4,000 unique tyre and undercarriage options.

Tyres, wheels and tracks

Solid rubber wheels have been around even longer than pneumatic tyres, hitting the road in the mid-1800s following the invention of vulcanised rubber in 1844 by Charles Goodyear.

Even for solid wheels, there are large differences in quality and effectiveness. Quality rubber is generally more costly to manufacture and remains a closely guarded secret by the companies that hold the formulas.

Servicing the agricultural industry for track undercarriage wheels and the underground mining industry for high-capacity solid wheels, Big Tyre knows the importance of quality rubber to provide a long-lasting product.

Big Tyre can arrange fittings for high-quality undercarriages and tracks nationwide for any location

As a world-leader in the industry, over the last 30 years, Big Tyre has manufactured nearly 15,000 solid rubber and polyurethane wheels, many of which have been exported to over 50 countries around the world.

Rubber tracks made their first appearance in the mid-1900s but didn’t become popular until the end of the century. Soon enough, Big Tyre had its first customers asking for track repairs or new tracks.

Over the past 25 years, Big Tyre has repaired and rebuilt over 1,300 rubber tracks, providing their customers a collective saving of over $10 million compared to the cost of buying new tracks.

With this specialised knowledge of tracks and their application and benefits within the agricultural industry, Big Tyre has been awarded the Australasian distributorship for Trackman (formerly known as Continental) and Firestone tracks, which gives Big Tyre two of the top three quality brands available on the market.

With their extensive knowledge, repair skills, and plenty of quality tracks kept in stock, Big Tyre is perfectly placed to provide a reliable and cost-effective solution when you need it.

For Sale Listings (List it for FREE!)

Pricing and inputs: July 2025

Input costs and trends

As 2025 hits the halfway mark, the cost of inputs, ranging from employment to fertiliser and chemicals, has been clearly shown to be at the mercy of events at home and overseas. Overseas concerns range from the uncertainty about the actions of US President Donald Trump and how they may directly or indirectly impact Australia’s export markets. Also, the conflicts in the Middle East and Ukraine.

A bit closer to home, wage and superannuation costs have increased, while the weather has been mixed. In some areas, there’s been flooding and near cyclonic conditions. In others, a drought which seems to have no end.

As 1 July ticked over, the Fair Work Commission’s latest increase to the National Minimum Wage and modern award rates of 3.5 per cent came into effect. The superannuation guarantee also increased from 11.5 per cent to 12 per cent.

While not unexpected, and not as high as the 4.5 per cent called for by the ACTU, it’s still another increase growers have to deal with.

With the last AUSVEG Sentiment Report finding that labour costs are on average 41% of production costs, and up to 70% of costs in more labour-intensive systems, this increase will put further pressure on the margin squeeze.

At the same time, input prices have bounced around alarmingly due to the unrest in the Middle East. The significant and immediate impact that the conflict between Israel and Iran has had on Australian fuel and fertiliser prices is a clear illustration of Australia’s dependence on fragile global supply chains and the value of local production wherever possible.

There are some glimmers of hope that exposure may be lessened in time, at least for fertilisers, as you can read below. In a previous edition of the pricing and inputs update, we looked at the struggles of Australian urea projects to get off the ground. This time, we look at several phosphate projects, where the picture looks more promising.

In an increasingly uncertain global trade environment, it would certainly be a positive step for Australia’s food security if our growers could enjoy the same local supply chains as the country’s vegetable consumers.

Don’t forget to tell us how these issues are affecting your business. AUSVEG’s July 2025 Industry Sentiment Survey has recently been released. Make sure you have your say here to ensure the most urgent issues facing our sector are heard loud and clear as Parliament resumes on 22 July.

Fertiliser

Urea prices have shot up in recent weeks due to the hostilities between Israel and Iran. Egypt halted urea production on 13 June after Israel, which supplies Egypt’s natural gas feedstock, froze operations at its offshore gas fields due to risks from Iranian missile strikes.

Similarly, Iran’s seven urea plants were idled due to Israeli strikes. Egypt and Iran collectively accounted for almost 20 per cent of global urea trade last year.

Production in both countries resumed following the shaky ceasefire; however, it has started to bring prices back down, albeit still well above pre-conflict levels.

Iranian threats to close the Strait of Hormuz are also a major concern. Closure of the Strait would severely restrict more than 40 per cent of global offshore urea trade from producers in Qatar, UAE, Bahrain, Saudi Arabia and Egypt. Even if the Strait isn’t closed, it appears likely that insurance premiums for shipping in the region will rise, which will no doubt flow through to landed urea pricing.

More than half of Australia’s urea imports come from the Middle East, according to commodity analyst Argus Media, meaning supply disruptions there have a rapid impact on domestic pricing.

For phosphates, global DAP and MAP prices have also risen, driven by tight global supply, firm seasonal demand and rising freight costs.

Australia currently imports around 88 per cent of its phosphate requirements, meaning all those global disruptions have a direct impact on local pricing. That may change in future, however, with some major phosphate projects progressing in northern Australia:

Verdant Minerals’ Ammaroo project: recently granted two mining leases in the NT, and given ‘major project’ status by the Federal Government last year, the project aims to tap into one of the world’s largest undeveloped phosphate resources. Verdant Minerals plans to build processing capacity to produce around 1M tonnes of ammonium phosphate fertilisers per annum. The project still has several approval and finance hurdles to jump.

North West Phosphate’s Paradise South project: given priority status by the Queensland Government last month, the Paradise South project is expected to mine up to 2M tonnes of phosphate ore per annum, and will process the ore into phosphate concentrate.

On the other side of the ledger, however, Dyno Nobel (formerly Incitec Pivot) is undertaking a strategic review of its Phosphate Hill facility due to the rising cost of gas. Phosphate Hill is expected to produce 740,000-800,000 tonnes of MAP and DAP fertilisers in FY2025, and has been the major domestic supplier of phosphate fertilisers for many years.

Urea pricing (Australia) Jan 2025 to June 2025 (AUD)

Source: Episode 3

Diesel

Diesel pricing had enjoyed a slow but steady easing for the first half of this year, but the recent conflict between Israel and Iran has sent oil prices, and thus diesel, into a spin over the past few weeks.

The Brent crude oil price jumped from US$69.36 a barrel on 12 June, before the conflict, to US$79 on 23 June.

Following the ceasefire between the two countries, however, pricing has come back down. You can see in the most recent weeks in the chart below how responsive Australian diesel pricing has been to these disruptions, so the outlook over the next few months is essentially dependent on political developments in the Middle East.

The graph below shows Australian wholesale diesel prices (National Diesel TGP) against the Singapore wholesale price (Gasoil).

Australia imports almost 70 per cent of diesel, predominantly from Asia, and Gasoil sets the price benchmark for Australia. A prediction of Australian diesel prices can be found by following the Singapore Gasoil price; Australian pricing lags 1-2 weeks behind. You can follow the Australian Institute of Petroleum’s diesel price reports here.

Australian wholesale diesel price (TGP) vs Singapore diesel price (Gasoil) June 2023 to June 2025

Source: Australian Institute of Petroleum

Energy

Following six months of price relief, wholesale electricity costs jumped again in June and are staying at similar levels heading into July.

Average June spot prices were the second-highest in history for that month, after June 2022. There are a few factors behind the spike:

Low hydropower generation due to Snowy Hydro water shortages.

‘Triple C Day’ crisis – a cold, calm and cloudy day on 26 June that reduced wind and solar generation, but drove peak heating demand, shooting spot prices to ‘extreme’ levels.

The continuing outage of five major coal generators.

Increased costly gas generation to close the gap.

National Energy Market Volume Weighted Price ($/MWh)

Source: Open Electricity

Retail market data

CPI

The monthly Consumer Price Index (CPI) indicator was at 2.1 per cent in May, only a small drop from the previous month.

Fruit and vegetable CPI dropped significantly, however, from 6.1 per cent in April to 2.8 per cent in May. The ABS attributes this primarily to a drop in fruit prices, particularly mandarins, oranges, avocados and apples.

The graph below shows the Australian Bureau of Statistics (ABS) monthly CPI indicator for fruit and vegetables, which represents each month’s percentage change from the same month the year before.

Monthly CPI Indicator – fruit & veg vs all groups

2023-2025

Source: ABS

Retail sales

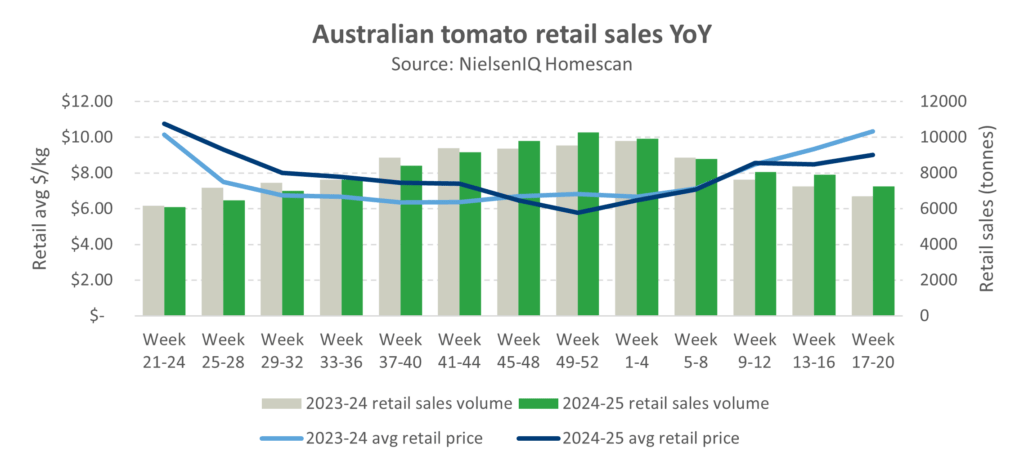

The charts below show NielsenIQ Homescan data for potatoes, onions, carrots, lettuce, broccoli and celery, provided through Hort Innovation’s levy-funded Consumer purchase and retail data (MT21004) program.

The data is presented in four-week periods, with the period ending on 18 May 2025.

Average monthly vegetable retail prices so far this year have stayed above those 12 months prior, but by a lower margin than in the second half of 2024. Average monthly total vegetable retail prices were 4 per cent higher YoY, whereas prices in the last six months of 2024 were 10 per cent higher.

Retail sales volume has also been resilient, tracking very close to the same period in the previous year. In fact, total vegetable retail sales volume is only 0.2 per cent lower YoY over the past 12 months, despite prices being 7.2 per cent higher. That’s generated an additional $457m in retail sales, according to Nielsen’s figures.

These results have played out across all the major vegetable categories. Celery and tomatoes had slower retail growth, with total retail sales increasing by only 3.4 per cent and 3.8 per cent, respectively. Fresh tomato supply has been disrupted due to the Tomato Brown Rugose virus, and this has affected price and volume.

The high performers have been broccoli, at 13.1 per cent, lettuce at 10.5 per cent, and carrots at 10.4 per cent YoY growth in retail sales value.

Featured Auction Listings

RGA - REALM GROUP AUSTRALIA - MULTI-VENDOR MACHINERY AUCTION, AUSTRALIA WIDE

We’re now taking listings for our next up-and-coming auction.

Contact us today!

AG NEWS AUSTRALIA

CONGRATULATIONS ROBBIE McKENZIE, CEO REALM GROUP AUSTRALIA JUNE 2025 FLUXX AWARD - SUSTAINABILITY LEADER OF THE YEAR

In June 2025, REALM Group CEO Robbie McKenzie attended the 2025 FLUXX Awards in Hong Kong.

The FLUXX Awards celebrate global excellence and bring together some of the world’s most elite professionals, forward-thinking innovators, and influential leaders, with a reputation for setting benchmarks in business, healthcare, technology, sustainability, and social impact.

These awards recognize the achievements of those who push boundaries and drive positive change, and are one of the most prestigious global events celebrating excellence across various industries, and are recognized as a symbol of innovation, leadership, and impact. The FLUXX Awards honour individuals and organizations that have demonstrated outstanding achievements in their respective fields.

Please join me in congratulating Robbie on this massive achievement. His hard work, dedication, and tireless effort have led him to this well-deserved success.

Anne Watkins,

REALM Group Australia

Administration

Simply click www.payintime.com.au to provide your details, and we will be in touch. It all starts with one phone call.

YOUR TOWN

We Have Been to Your Town! We don’t just sit in an office; we are hands-on with our Farmers! 🙌

Please email us with a picture of yourself or a family member in front of your TOWN-SIGN to [email protected]

Welcoming Jamie Ramage ( Ramage Digital )

A Strategic Long-Term Venture with REALM Group Australia

Some people build businesses. Jamie Ramage builds trust.

Over the past two decades, Jamie has earned a reputation as someone who delivers, whether in agricultural sales, consultation, or regional marketing. He’s worked on the ground with farmers, families, and founders across Australia, always bringing a clear head and steady hand to whatever challenge is in front of him.

Jamie isn’t a creative director, and he’ll be the first to say it. What he brings instead is vision, strategy, and the humility to surround himself with a team of thinkers, designers, and doers who know their craft. At RD Creative Studio (formerly Ramage Digital), Jamie leads from behind—not to control the process, but to ensure the work stays aligned with what clients actually need.

This studio, under Jamie’s leadership, focuses on clarity. On designing brands that reflect real people and real priorities. On building content and strategy that make sense in Shepparton, Wagga Wagga, and Moree, not just Melbourne and Sydney.

Jamie’s long-term partnership with REALM Group is rooted in shared values: respect for the customer, pride in your work, and a belief in the power of education not just as a principle, but as a practice.

Both teams are committed to equipping clients with the knowledge, tools, and confidence to make smarter decisions. After all, in industries where trust is earned, informed clients are empowered clients.

This next chapter is about scale with substance. RD Creative Studio will serve as the creative and digital partner for rural and regional businesses who are ready to grow without losing sight of who they are.

Want to connect or learn more? Jamie’s door (and inbox) is always open: 📩 [email protected]

Women in Ag

Welcoming Amanda Burchmann – A Strategic Long-Term Venture with REALM Group Australia

Biosecurity - Why Biosecurity Isn’t Just for Big Farms

I hope everyone has had some of the amazing rain that has been around.

Today, I want to touch base on biosecurity for small livestock producers and hobby farmers.

The word biosecurity might seem like something that only applies to large commercial operations. But the truth is—biosecurity is everyone’s responsibility.

Whether you're running a small mob of goats, a handful of sheep, or a few head of cattle, implementing simple biosecurity measures can safeguard your animals, your property, and the reputation of Australia’s disease-free livestock industry.

🧯 What does biosecurity mean for you? It’s all about minimising risks: isolating new animals, managing movement, keeping facilities clean, and maintaining clear records. Think of it as farm insurance—it’s far easier to prevent disease than to control it once it arrives.

🔍 Why it matters more than ever: Australia’s enviable disease-free status supports our market access and consumer trust globally. But smaller properties often face greater risk due to limited vet access, informal transactions, and fewer compliance tools. That’s why it’s crucial to stay proactive and informed.

📋 Are you part of the LPA? If you’re buying or selling livestock, you should be. The Livestock Production Assurance (LPA) Program ensures producers follow standards for food safety, traceability, and animal welfare—including having a written biosecurity plan and using National Vendor Declarations.

✅ How you can get started today: Quarantine new or sick animals. Use footbaths and clean gear, keep accurate records, talk with neighbours and mentors. Download or complete a free Biosecurity Plan

🔗 Full article + helpful links: 👉 Read: “Understanding Biosecurity: Why It Matters for Small Producers and Hobby Farmers” - https://www.jabagrisolutions.com.au/knowledge/understanding-biosecurity-why-it-matters-for-small-producers-and-hobby-farmers

If you need help getting started with your LPA biosecurity plan, or are not sure where to begin? Reach out—we're here to make compliance simple and practical.

Kind Regards,

Amanda Burchmann

Livestock Production & Industry Development Specialist

Founder | Advocate | Producer

📞 0408 847 536

📧 [email protected]

🌐 www.jabagrisolutions.com.au

“Samantha Watkins Photography”

REALM Group Australia is proud to sponsor amateur photographer Samantha Watkins. We've seen her photography skills grow tremendously over the years, and we believe it's the perfect time for her to step into the photography world.

Click on the link to take you to her FB photography page, where you can see her beautiful photos.

It is called "Samantha Watkins Photography" https://www.facebook.com/profile.php?id=61573116870308

Samantha Watkins's sample photography.

All photos are available for purchase – simply email [email protected]

And she will be happy to assist you.

Active & Upcoming AUCTION!

(Under Auction Listings)

Let us know what you have to sell or auction - it’s FREE to List, and FREE to advertise. Please email [email protected]

Let us help you with your financial needs. Click Here www.payintime.com.au

Let us help you with your financial needs. Click Here www.payintime.com.au

— Robbie McKenzie

Realm Group Australia

REALM Group Australia (RGA) - originally est. 1992. The most trusted online Ag Marketing System in Australia. Built by Farmers for Farmers! Education is the KEY. True Pioneers - We were the first, and we are still growing. Proud Supporters of the Royal Flying Doctor Service (RFDS) & Ronald McDonald House Charities (RMHC)